NOK/JPY

The dollar traded unchanged or higher against all of its G10 counterparts during the European morning Monday in the absence of any material economic events. It was higher against NOK, NZD, CAD, GBP, SEK and AUD, in that order, while it remained unchanged against EUR, JPY and CHF.

Once again, investors increased their demand for safe-haven assets due to heightened geopolitical risks in Ukraine, following last Thursday’s downing of the Malaysia Airlines plane. Britain, Germany and France agreed on Sunday that they should be ready to announce a new round of sanctions on Russia at the European foreign ministers meeting in Brussels on Tuesday.

Oil was the main winner during the European morning session. It moved again above 103.00, confirming the rebound from the 102.60 support zone. I still expect the price to challenge the area of 103.90. Similarly, gold rallied from its opening level this morning to trade around 1310, just below where it jumped to after last Thursday’s tragedy.

On the other hand, stock markets declined across Europe over news that Ukrainian government forces were trying to break into the rebel-held city of Donetsk and fears that tensions between Russia and the West may rise. All the above supports my view that we are likely back to a “risk-off” world.

NOK is the G10 currency that tends to depreciate most when European stock markets decline. On the other hand, the yen tends to gain during periods of risk aversion. Putting the two together, selling NOK/JPY would seem to be an effective way from a fundamental view to play the Ukraine crisis through the FX market.

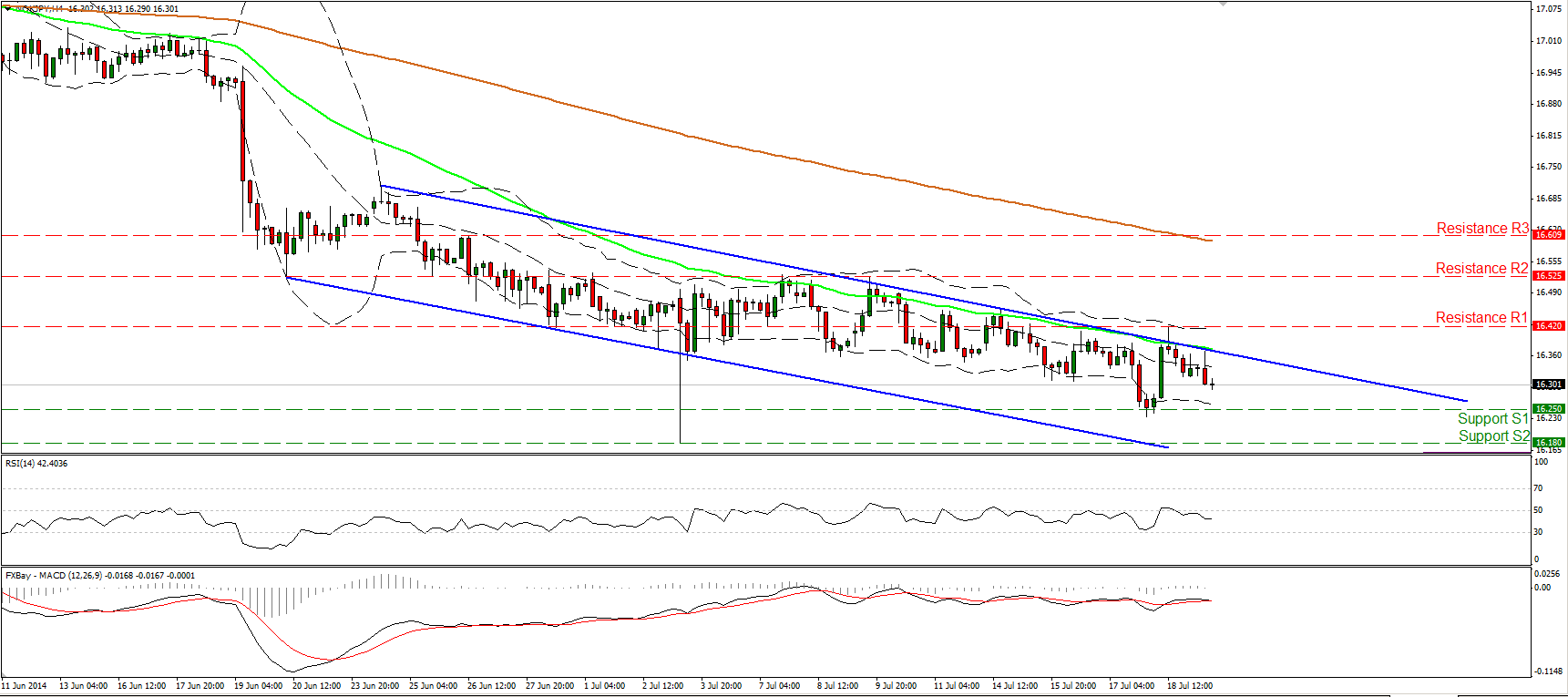

However, the technical picture for NOK/JPY may be limited. The pair declined as expected during the European morning Monday, after finding resistance at 16.420 (R1), near the upper boundary of the near-term downside channel. A clear dip below the support of 16.250 (S1), would confirm a forthcoming lower low and is likely to target the next obstacle at 16.180 (S2), or the lower bound of the downtrend channel. Both our momentum studies support the notion, since the RSI fell below its 50 level, while the MACD, already within its negative field, seems ready to move below its signal line. As long as the rate is trading within the aforementioned channel and below both the moving averages, I see a negative near-term outlook. Nevertheless, although the short-term trend is to the downside, the rate is approaching a longer-term upside support line (drawn from back 24th of June 2013 and connecting the lows on the daily chart). This leads to the conclusion that any further downside could be limited near that line. Additionally, I can see positive divergence between our daily momentum indicators and the price action, while the 14-day RSI exited its oversold field, corroborating my view that any further declines are likely to be limited.

Support: 16.250 (S1), 16.180 (S2), 16.000 (S3)

Resistance: 16.420 (R1), 16.525 (R2), 16.610 (R3)

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.