AUD/NZD

Forex markets were relatively quiet during the European morning Wednesday, with the dollar trading virtually unchanged against most of its G10 counterparts. The greenback was higher against NZD, EUR and CHF, in that order, while it was lower against NOK.

The New Zealand dollar extended its overnight loses after the weaker-than-expected inflation data and the additional decline in dairy prices at the latest auction. Chinese 2Q GDP showed better-than-expected growth, however a statement by a person from the Chinese statistical Bureau that problems in the nation’s property sector may exert downward pressure on Chinese growth added to the Kiwi decline.

As for this morning’s indicators, the unemployment rate in the UK fell to 6.5%, a five-year low, in line with estimates. Nevertheless, Cable weakened at the release of the news as the focus was on the average weekly earnings, which slowed in pace to +0.3% yoy (3 month average) from an upwardly revised +0.8% yoy. The slow growth in wages indicates that there is still spare capacity in the labor market and the Monetary Policy Committee is likely to conclude that there is no urgent need to tighten.

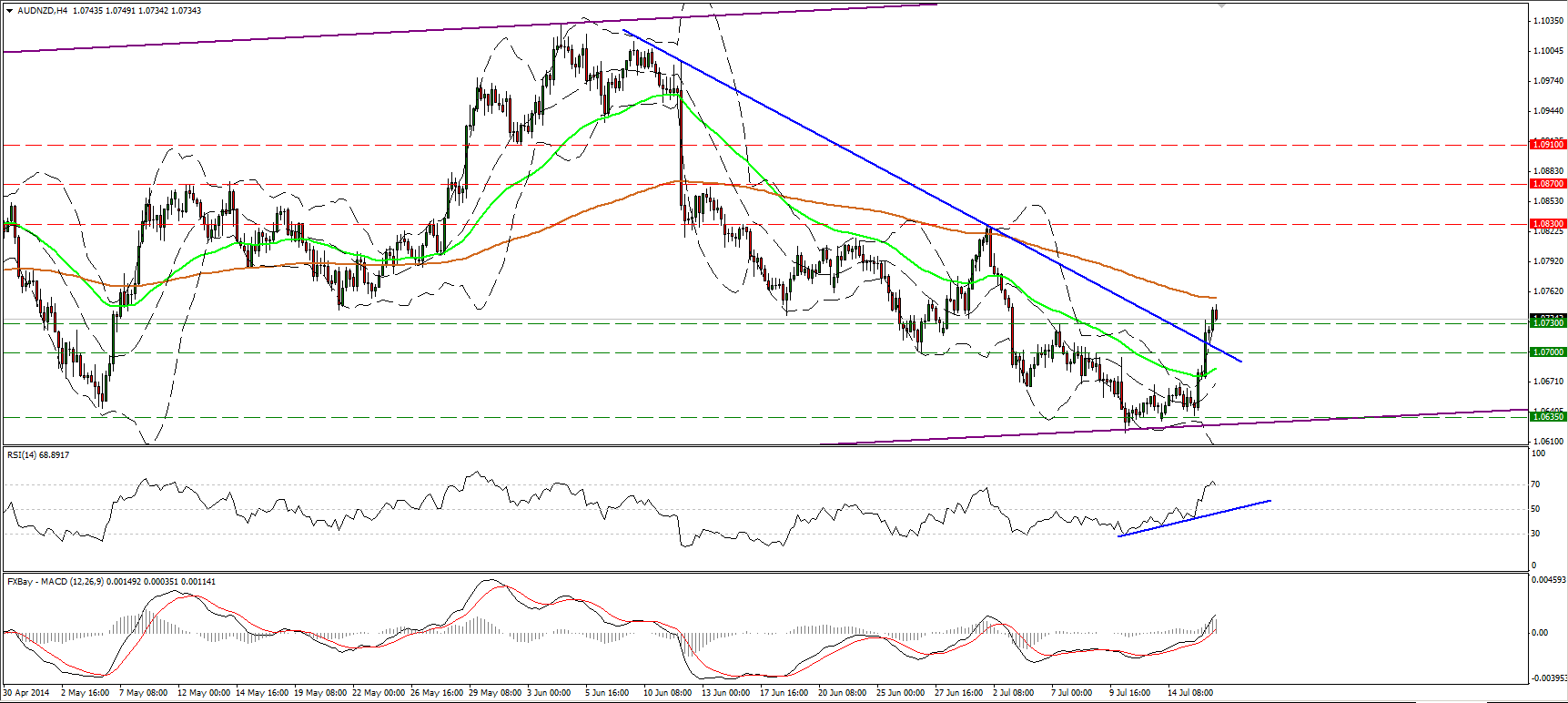

AUD/NZD surged during the Asian morning Wednesday and extended its advance during the European morning. The rate emerged above the short-term blue downtrend line and broke above the high of 1.0730 (resistance turned into support), signaling a possible short-term trend reversal. Both our momentum studies continued their upside paths, with the MACD crossing above both its signal and zero lines. This designates the recent accelerating bullish momentum, but having in mind that the RSI is likely to exit its overbought zone, I would expect some consolidation near the 1.0730 (S1) zone before the bulls prevail again. All the above provide ample evidence that a near-term trend reversal is in the game with the rate seeing scope for further extensions, probably towards the resistance zone of 1.0830 (R1), first. In the bigger picture, on the daily chart, the price rebounded from the lower boundary of an upside sloping channel, drawn from the highs and the lows of January and alongside our daily momentum studies supports the notion for a forthcoming near-term uptrend. The 14-day RSI is pointing up, ready to move above its 50 level, while the daily MACD has bottomed and moved above its signal line.

Support: 1.0730 (S1), 1.0700 (S2), 1.0635 (S3).

Resistance: 1.0830 (R1), 1.0870 (R2), 1.0910 (R3).

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0700 after German GDP data

EUR/USD is keeping the red near 1.0700 as investors await inflation and growth data for the Eurozone. The data from Germany showed that the GDP contracted at an annual rate of 0.2% in Q1 as expected, not allowing the Euro to attract investors.

GBP/USD remains pressured toward 1.2500 on US Dollar rebound

GBP/USD is extending losses toward 1.2500 in European trading on Tuesday. A cautious risk tone and a decent US Dollar comeback weigh negatively on the pair. The focus now shifts to mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.