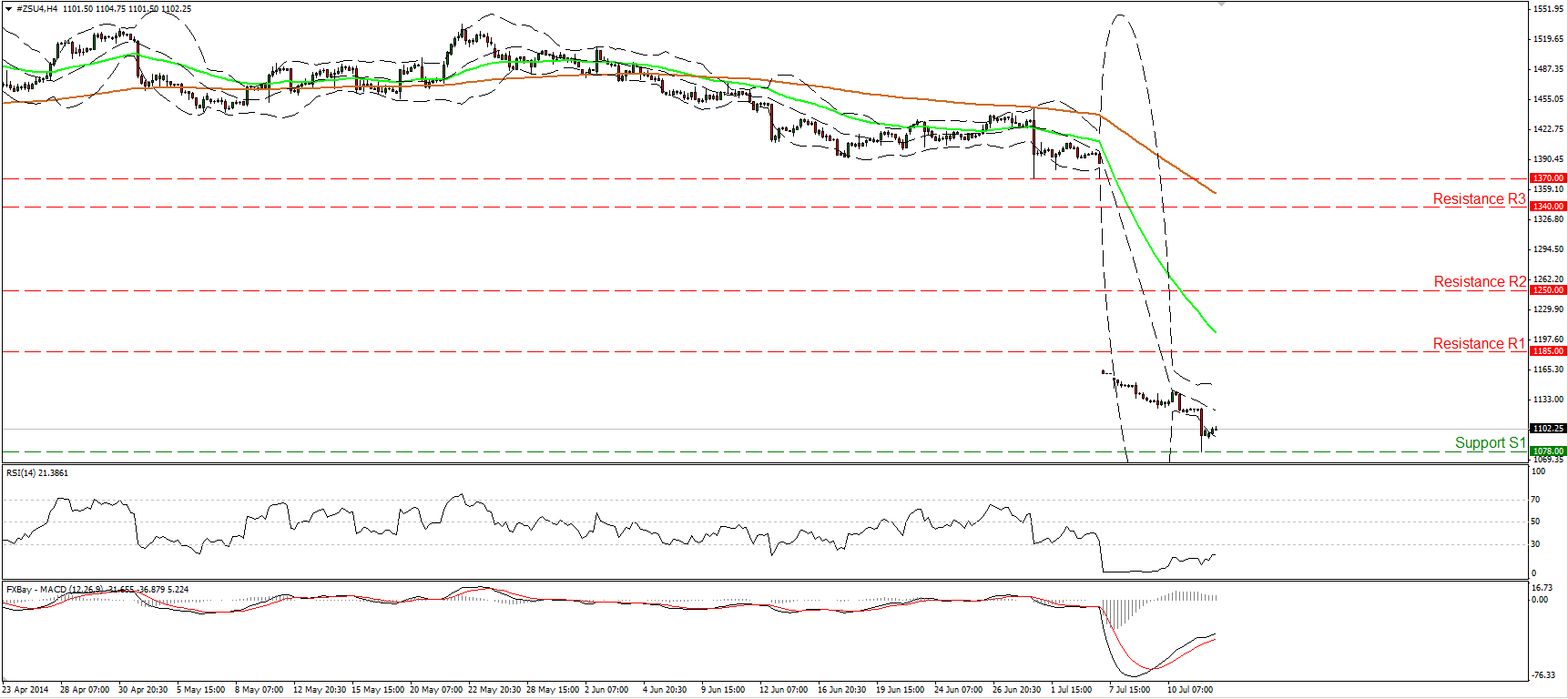

September Soybean futures

The dollar traded lower or unchanged against most of its G10 counterparts during the European morning Monday. It was lower against SEK, CHF, EUR and NOK, in that order, while it was higher against NZD. The greenback was virtually unchanged against JPY, AUD, GBP and CAD.

Stock markets in Europe rose as investors left behind last week’s concerns about Eurozone’s banks. The Portugal PSI 20 index opened approximately +1.40% higher on Monday after Banco Espirito Santo SA brought forward management changes and appointed the new chief executive officer and chief financial officer earlier than previously planned in an effort to distance the bank from the financial woes of its founding family.

However, as German Chancellor Angela Merkel said on July 12 “The example of a Portuguese bank showed us in the last few days how quickly the so-called markets are roiled, how quickly uncertainty returns and how fragile the whole euro construction still is.” Today, investors will turn their focus on ECB President Draghi’s testimony at the EU Parliament and see how he will respond to the situation in the Portuguese banking sector.

Soybeans, corn and wheat prices fell sharply on Friday after the U.S. Department of Agriculture (USDA) projected bigger-than-expected harvests and stockpiles this year, extending months of market bearishness for three of the biggest U.S. crops by value. Stockpiles of soybeans on Aug. 31, 2015, before next year’s harvest, will total 415 million bushels, the U.S. Department of Agriculture said. Most crops are in good or excellent condition after ample rain, USDA data showed.

September Soybean futures opened with a huge gap to the downside last Monday, with the price trading below the1185 (R1) barrier for the whole week. Today, during the European morning, soybean futures found support at 1078 (S1) and moved somewhat higher. The MACD, although in its bearish territory lies above its trigger line, while the RSI lies within its oversold territory, pointing up and looks ready to exit the extreme territory in the near future. As a result, I would expect the rebound to continue, perhaps to challenge the zone of 1185 (R1) as a resistance this time. Despite the fact that I believe more upside is likely in the short-term horizon, the possibility for a lower peak seems high and thus I would see any further advances as a correcting phase before the bears prevail again. As long as the price is trading below both the moving average, the outlook remains negative and a move below the 1078 (S1) support in the future could probably signal the continuation of the downtrend, targeting the psychological zone of 1000 (S2). Moving on the weekly chart, we can see that the last time we saw soybean futures below 1078 (S1) was back in October 2010. Having that in mind, I would wait for a weekly close below 1078 (S1) before seeing trend continuation.

Support: 1078 (S1), 1000 (S2), 925 (S3).

Resistance: 1185 (R1), 1250 (R2), 1340 (R3).

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.