AUD/USD

The dollar traded mixed against its G10 counterparts during the European morning Thursday. It was higher against AUD and GBP, in that order, while it was lower against SEK and JPY. The greenback traded nearly unchanged against CAD, NZD, EUR, CHF, and NOK.

AUD was the main loser during the European morning after a rise in the nation’s unemployment rate in June to 6.0% from an upwardly revised 5.9%. The jobless rate raised concern about its stalled economy and add to expectations that interest rates may remain on hold for months to come. Aussie weakened further when China, Australia’s biggest trade partner, reported lower than expected import data – thus weaker export data for Australia -- adding to the South Pacific nation’s losses. This confirms our bearish view on AUD, which is based on the idea that the slowdown in China will continue to erode Australia’s terms of trade and thereby weaken the AUD.

The Swedish krona strengthened to the most in a week after the nation’s CPI rose by 0.2% yoy in June, a rebound from deflation of -0.2% yoy. The figure was better than the forecast of a rise to a 0.0%, easing some of the concerns about deflation. USD/SEK and EUR/SEK declined at the release, with the latter approaching our support zone of 9.2100. Although the country exited deflationary conditions for the first time after five months, the rate is still far from the Riksbank’s 2% target and I would not expect the Bank to change its tone any time soon. As a result, I still expect the Krona to weaken and I would consider today’s rally as a renewed selling opportunity.

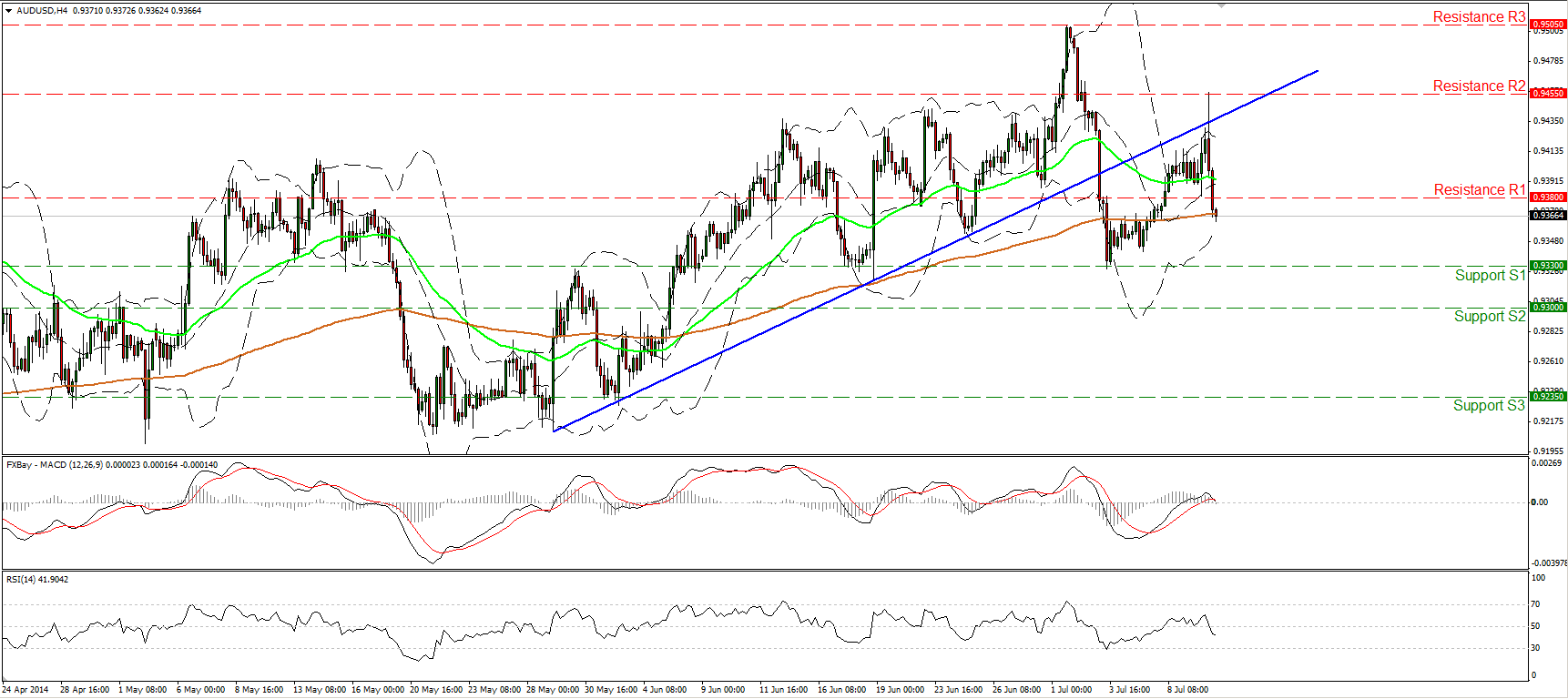

AUD/USD plunged during the Asian day, after finding resistance at 0.9455 (R2), and continued declining during the European day, breaking below the 0.9380 barrier. I would expect such a break to trigger extensions towards the support zone of 0.9330 (S1) first, where a clear dip would confirm a forthcoming lower low and maybe target the key zone of 0.9300 (S2). In my view, the rate has the necessary momentum to continue its decline. The MACD just crossed below its signal line, and seems ready to enter its negative field, while the RSI fell below 50 and has more to go before signaling oversold conditions. As long as the rate is trading below the prior uptrend line, drawn from the lows of June 29th, I see a negative short-term picture.

Support: 0.9330 (S1), 0.9300 (S2), 0.9235 (S3).

Resistance: 0.9380 (R1), 0.9450 (R2), 0.9505 (R3).

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.