USD/NOK

The greenback traded mixed against the other G10 currencies during the morning in Europe. It was higher against SEK, EUR and CHF, while it depreciated against NOK, NZD and GBP. It remained near its opening levels against JPY, AUD and CAD.

Today, the Norges Bank decided to keep its benchmark rate unchanged at 1.5% as expected by all 18 economist surveyed by Bloomberg. NOK strengthened nonetheless as the Bank maintained its forecast that it will start raising its key rate gradually after summer 2015 and said that projections for the Norwegian economy show that growth will pick up somewhat further ahead.

NZD was the second-best gainer as the country’s trade surplus rose to NZD 818mn in February, beating market estimates of NZD 600mn.

Sterling was among the winners, after retail sales excluding auto rose 1.8% mom in February, beating market expectations of +0.3% mom. This reassures investors that the consumer demand driving UK growth has not yet run out of steam by any means. There have been concerns that consumer demand would start to slow down as incomes aren’t growing as much as spending is. The fact that retail sales increased so much when the rainfall in some parts of the country was almost 2.5 times the monthly average makes the figure even more impressive.

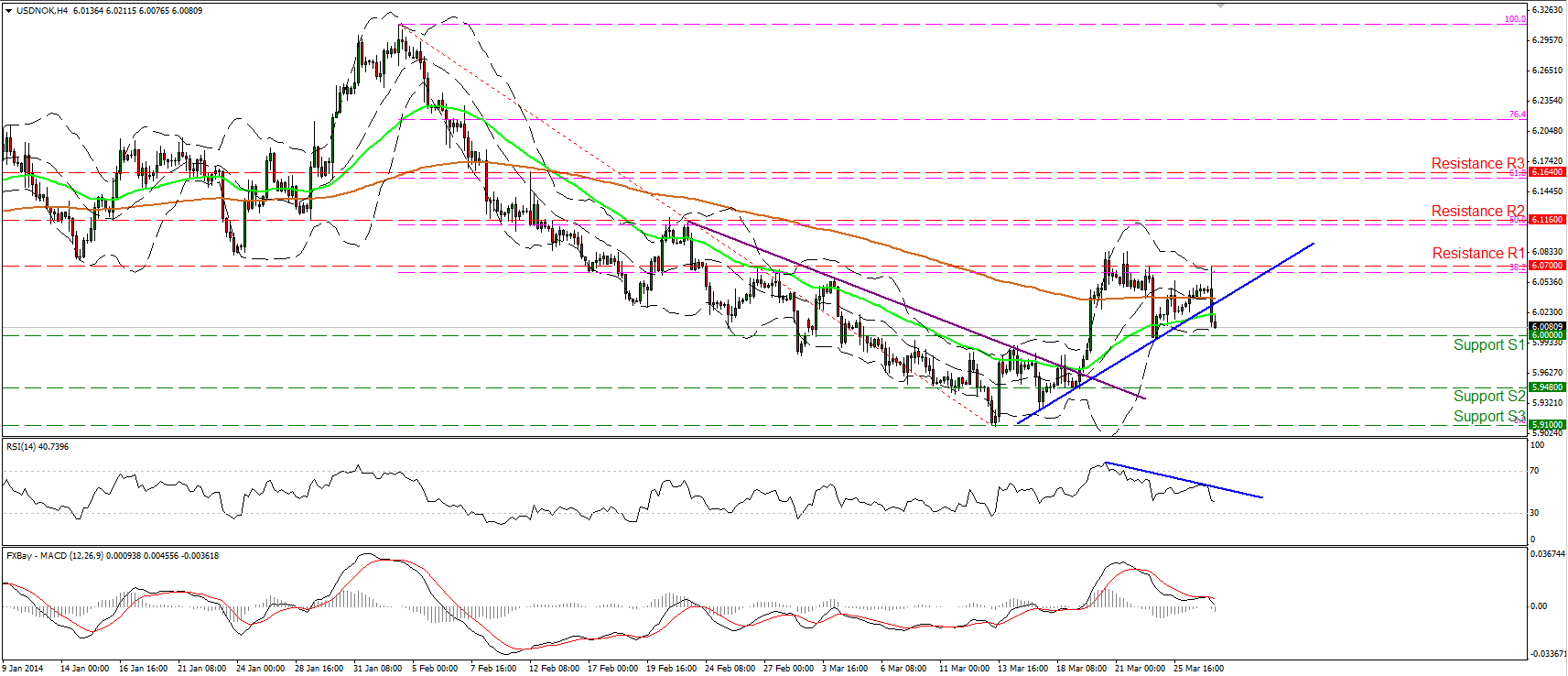

USD/NOK fell below its blue support line during the European morning after finding resistance at the 6.0700 (R1) bar, near the 38.2% retracement level of the 4th Feb – 13th March downtrend. The pair is now heading towards the key support barrier of 6.0000 (S1), where a clear dip may signal the completion of a failure swing and target the next hurdle at 5.9480 (S2). The RSI follows a downward path, while the MACD lies below its trigger line and is heading towards its zero line, where a dip will confirm the negative momentum of the price action.

Support: 6.0000 (S1), 5.9480 (S2), 5.9100 (S3)

Resistance: 6.0700 (R1), 6.1160 (R2), 6.1640 (R3)

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.