Middling economic data persisted in the US but markets showed some signs of stabilization ahead of non-farm payrolls. The Swiss franc was the top performer while the pound lagged after the BOE. Australian retail sales are up next.

Click To Enlarge

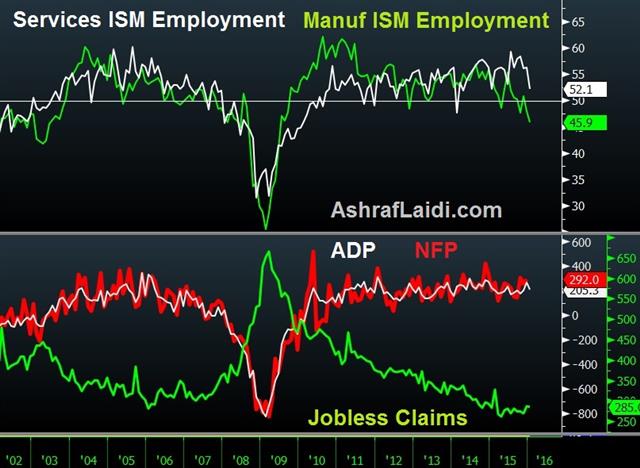

The US dollar fell hard in early New York trading and it looked like an extension of yesterday's rout. The Dec factory orders report fell 2.9% vs 2.8% expected and it was compounded by a 0.5 pp downward revision to the prior report. Initial jobless claims were at 285K compared to 278K expected.

The high of the day in EUR/USD was immediately after the data at 1.1238 but then the dollar bleeding stopped. The euro fell back to 1.1160 before finishing at 1.1200.

The Fed's Kaplan underscored the recent tentative tone, saying the Fed wants to normalize but it can't be forced. He also fretted about tightening financial conditions. The dollar barely recovered against the yen throughout the day but it made progress against CAD, climbing 100 pips from the lows. It was aided by a 59-cent drop in oil despite the usual OPEC jawboning and headlines about Syria.

The pound was extremely volatile. It fell hard on the 9-0 vote to hold rates as McCafferty abandoned his hawkish stance. It soon recovered as Carney talked up the prospect of cuts (eventually) but then fell back on weaker growth forecasts.

Position squaring ahead of non-farm payrolls might have also helped the dollar, and broader markets, stabilize. The consensus is for 190K new jobs but the momentum is a bit lower with some forecasts revised lower after the weak ISM non-manufacturing report, notably Goldman taking its call to 170K from 190K.

In any case, it's tough to see how the jobs report could be a game-changer for the Fed or the market.

What may end up being a bigger factor for markets is the Australian Dec retail sales report. It's expected to rise 0.4% and will be released at the same time as the RBA Statement on Monetary Policy, which is a more detailed breakdown of the RBA thinking than the monetary policy decision.

Canadian jobs will also be released on Friday.

Earlier in the week, we floated the idea that perhaps the developed commodity bloc is a more resilient to the bust than the market believes because of 15 years of savings, ample space for fiscal stimulus and the FX moves. Friday's data will help begin to answer that question.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.