The Fed has suddenly rediscovered its data dependency as part of a slow walk-down from a March hike. The pound leaped higher on Monday while the US dollar lagged. The Australian dollar now moves into focus with the RBA up next.

Click To Enlarge

The Fed won't hike in March so officials are now working to re-establish credibility. Officials have suddenly rediscovered data dependency, which was something that didn't seem to matter when inflation was low and commodities falling in the weeks leading up to the December FOMC.

Less than a month ago the Fed's Fischer was talking about 'something in the ballpark' of four hikes this year. On Monday he said hiking four times was just one number that has been bandied about. He said inflation might be lower and that the Fed is data dependent.

It wasn't overtly dovish but the market senses the shift in rhetoric that will continue at next week's Humphrey Hawkins. The result was a broad slump in the US dollar.

Cable took advantage in a rally as high as 1.4448. That's nearly 300 pips from the low late on Friday and breaks above a recent series of highs to the best level in two weeks.

Most surprising was the Canadian dollar as it gained a half cent despite a 6% drop in oil prices. Flows may have been a factor to start the month because that divergence can't continue.

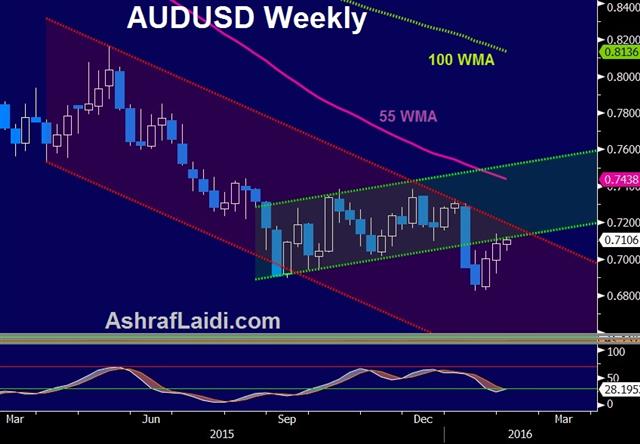

The commodity currency in focus in the hours ahead is the Australian dollar with the RBA due at 0330 GMT. Expectations for a change in policy are very low so the focus will be on rhetoric. Jobs growth and business sentiment have been resilient, as has the domestic economy on the whole. Stevens likely wants to preserve a dovish outlook, so expect him to emphasize risks from abroad. That likely won't be enough to hurt the Australian dollar and if he takes a more constructive outlook, AUD could rally.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.