Intraday market analysis: USD rally catches breath

USD/CHF seeks support

The US dollar goes sideways, following a slight improvement in last week’s initial jobless claims.

The rally has resumed after a breakout above 0.9230, the top range of the previous consolidation. Price action is rising along the moving averages as a sign of acceleration in the bullish momentum. 0.9310 is the next target.

The RSI has made its way back to the neutral area. Trend followers are likely to offer support as the price pulls back. 0.9200, the base of the rally is the first line of defense.

XAU/USD struggles to bounce

Gold treads water ahead of US nonfarm payrolls.

Indeed, the precious metal is striving to hold onto the key support at 1756, from the daily timeframe. Early buyers are getting in the game and challenging the immediate resistance at 1785.

The RSI is still in the neutrality zone. 1795 is a major hurdle and the bulls will need to lift these offers before they could expect a meaningful rebound. Then, 1824 would be the next target.

A fall below 1756 would lead to 1740 on the rising trendline on the daily chart.

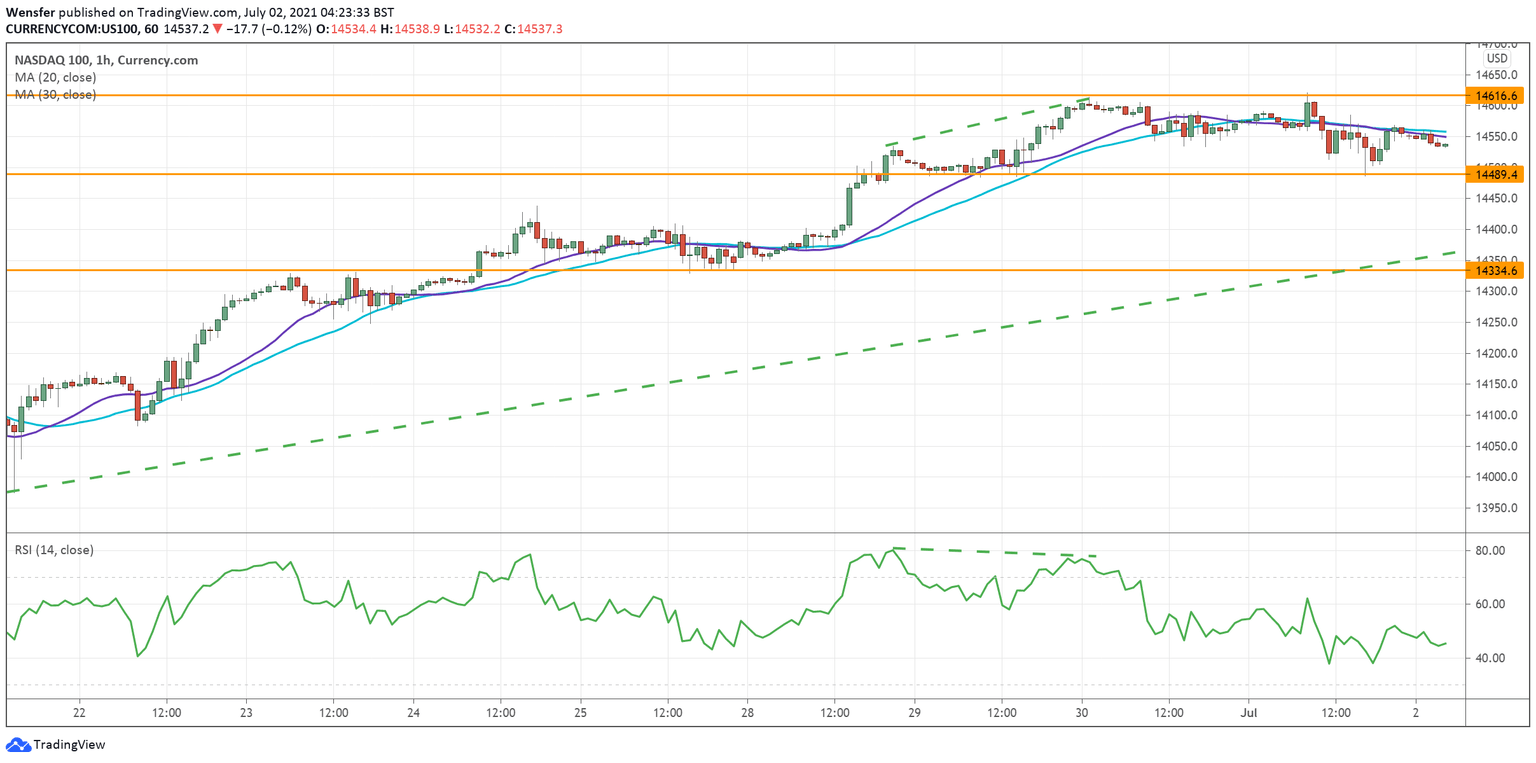

NAS 100 holds onto record high

The Nasdaq 100 climbs as investors rotate back into tech stocks.

The rally has gained traction after it broke above April’s peak at 14070. Momentum has pushed the index well above the rising trendline established in late May.

An RSI divergence suggests a deceleration in the impetus. While sentiment remains bullish, short-term bears may play mean reversion and push the price back to the trendline.

14490 is the closest support. Its breach could trigger profit-taking towards 14400.

14610 acts as a temporary resistance.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.