Whilst most economists are now predicting further cuts by the RBA, some saying even the cash rate may drop to 1% (meaning another -75bps), this is putting some downward pressure on the AUD.

As for the NZD, it is largely reliant on its Dairy trade as its key exports, and there has been a lot of media on the weak dairy prices. Keep an eye out for the RBNZ to intervene if the AUDNZD approaches parity, as its one of its key export markets, and they may follow the RBA with further rate cuts which may see the NZD change direction against the AUD.

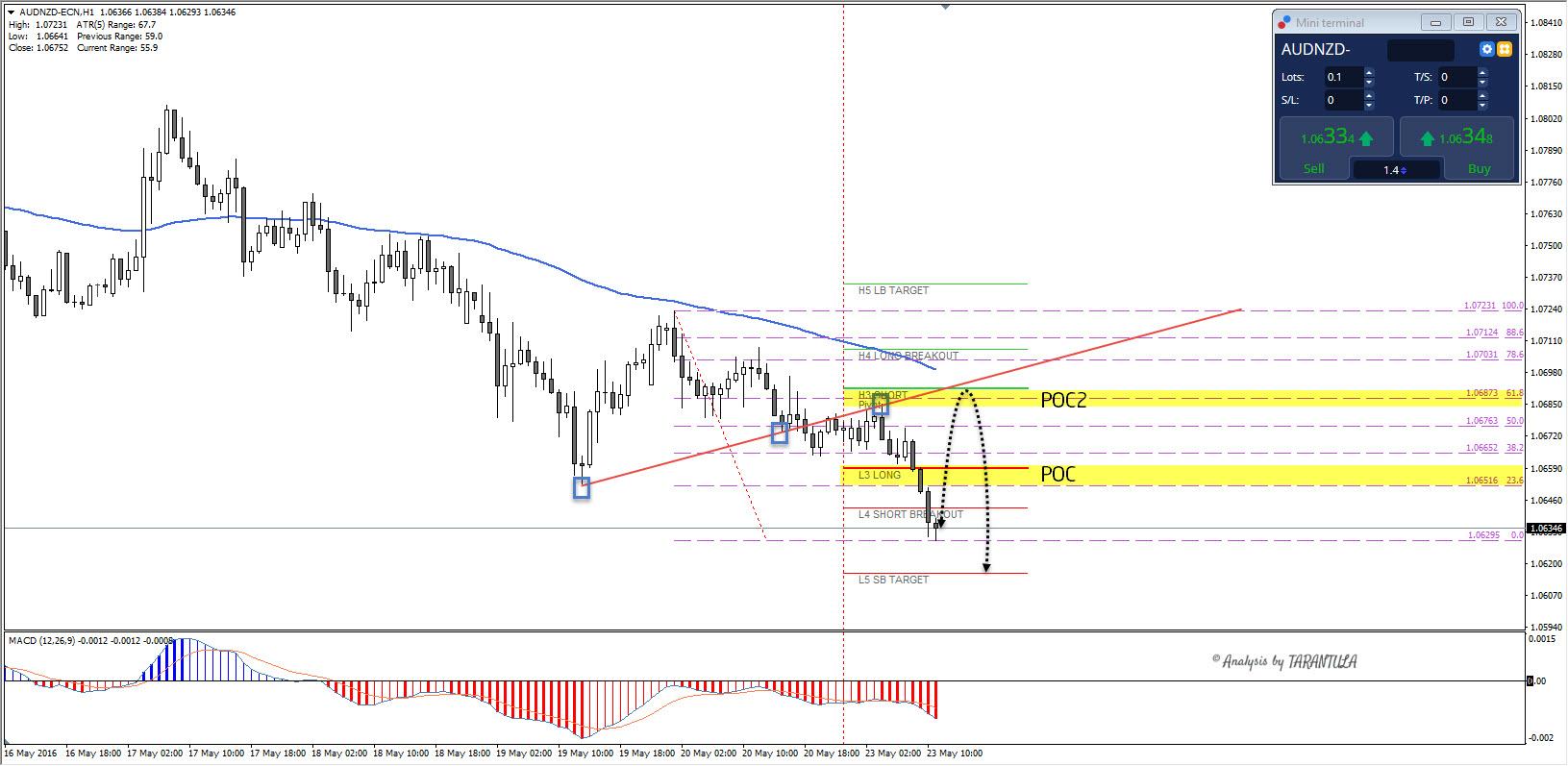

Technically POC comes within 1.0650-60 zone (L3,23.6, Breakout-retest) while deeper retracement may target 1.0685-95 zone (61.8, DPP, H3,inner trend line, EMA89). We could expect fresh sellers to kick in within POC zones targeting 1.0615 and 1.0570.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.