US Initial Jobless Claims Preview: Waiting for the second recovery

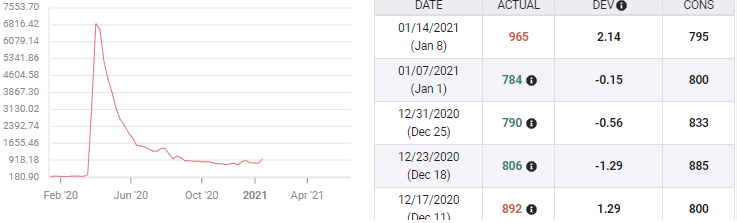

- Claims forecast to drop to 910,000 from 965,000.

- Prior week was a five-month high in requests for benefits.

- Continuing Claims expected to rise to 5.4 million from 5.271 million.

- High levels of layoffs predict weak or negative payrolls in January.

- California COVID-19 cases rise in spite of lockdown restrictions.

Initial Jobless claims are the focus of economic concerns in the United States as California's pandemic lockdown has crushed the recovering labor market.

Filings for unemployment benefits are forecast to drop to 910,000 in the January 15 week from 965,000 prior. Continuing claims are forecast to climb to 5.4 million from 5.271 million.

Initial Jobless Claims

Claims began to rise in the first week of December when they soared to 862,000 from 716,000 previous. By the end of the month the four-week moving average had jumped to 837,500 from 740,500 in November.

The increasing layoffs predicted, as they had in March, the collapse of job creation into losses for the first time since April. Non-farm Payrolls (NFP) shed 140,000 positions in December. The consensus forecast for NFP had been 71,000. The Janaury NFP numbers will be released on February 5.

California lockdown

The largest state economy continues to deteriorate under the strictest business and social restrictions in the country. Most of the state has been closed for more than a month, though compliance has been poor, with Los Angles and San Francisco under stay-at-home orders.

The business and social limitations and masking order have not had any appreciable impact on the number of virus diagnoses. While the latest case counts continue to rise hospitalizations have dropped 8.5% over the last 14 days and ICU use is down by a similar amount.

Because of the size of the Golden State economy, 14.7% of the nation's total, almost twice that of second place Texas, 8.5%, the lockdown and its attendant job losses is sufficient to skew the national claims and employment figures.

Nonfarm Payrolls

Job creation had been falling for months before it plunged into losses in December.

Nonfarm Payrolls

November's 336,000 new positions, while bolstered by the addition of 91,000 on revision, was still just half of the 660,000 average of September and October. Those two months in turn were less than half of the 1.627 million average of July and August. Keeping that logic the December payrolls should have been 155,000-175,000. The 300,000 swing is largely attributable to the California debacle, by far the worst in the nation.

Conclusion and the dollar

The dollar's modest recovery in January has been prompted by three factors. Treasury rates have gained their best levels since the pandemic. The incoming Biden administration is expected to launch a massive $1.9 trillion stimulus package and the vaccine roll-out is predicted to permit a gradual resumption of normal economic life in the second quarter.

These trends have not been altered by the increase in claims or the collapse of job creation in December and perhaps January. Markets will remain focused on the second quarter.

When and if these hopes become statistical reality the dollar will rise.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.