As many may have expected following the release of Australian inflation data last week that came out surprisingly lower-than-expected, the Reserve Bank of Australia (RBA) on Tuesday moved to cut interest rates by 25 basis points to a new record low of 1.75%. Prior to last week’s release of the inflation data, the RBA was not widely expected to cut interest rates, but since the Consumer Price Index showed prices falling by 0.2% vs. expectations of a 0.3% increase, speculation over a potential interest rate cut had increased markedly.

The RBA move on Tuesday occurs in stark contrast to the policy decisions of other major central banks last week that also had varying expectations of possible rate cuts, including both the Bank of Japan (BoJ) and the Reserve Bank of New Zealand (RBNZ). There was some prior speculation over potential further easing by the RBNZ, and certainly much anticipation that the BoJ would act with additional stimulus measures in attempts to halt the strengthening of the Japanese yen. In the end, however, both of these central banks opted to keep interest rates unchanged last week.

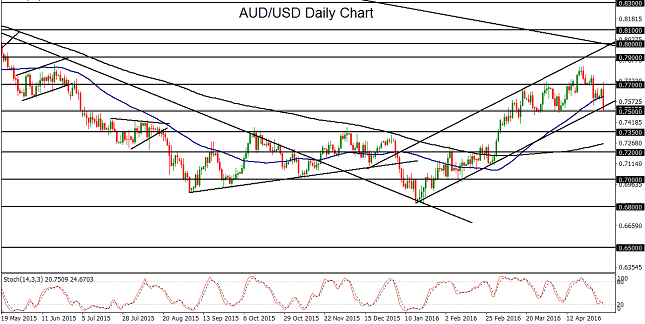

This contrast, especially in light of the unexpected disinflationary readings out of Australia last week, has led to a sharp drop in the Australian dollar against other major currencies, as might have been expected. For AUD/USD, the RBA rate cut has pressured the currency pair down to a major support target at 0.7500. In the process of this drop, price has also tentatively broken down below both its 50-day moving average and an uptrend line extending back to January’s multi-year lows near 0.6800.

In the event of a further sustained breakdown below the noted 0.7500 support, which would extend the recent two-week retreat from April’s 10-month high above 0.7800, the next major downside targets are at the key 0.7350 and 0.7200 support levels.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.