![]()

USD/JPY spent much of the past week in a relatively tight consolidation as a lagging US dollar was offset by rising stock markets. Tuesday, however, saw the currency pair drop as both crude oil and major global equity markets stalled and pulled back after their recent winning streaks.

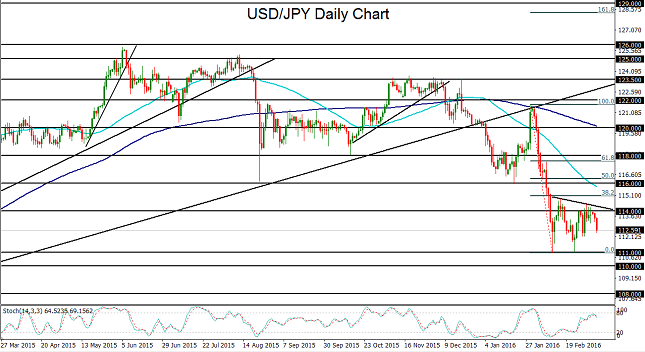

During the course of the past month, USD/JPY has plunged to establish a 15-month low around 111.00 support, re-tested that support level to form a potential double-bottom technical pattern, and then fluctuated in a consolidation above those lows. Shortly after that double-bottoming pattern, the currency pair struggled to climb towards the top of the consolidation, but was impeded both by technical resistance as well as a continuing sentiment of caution in the global stock markets.

USD/JPY tends to track stock indices relatively closely due in part to the role of the Japanese yen as a “safe haven” currency. As such, higher stock index prices often tend to result in a higher USD/JPY, and fear-driven drops in stocks tend to pressure USD/JPY due to capital being drawn back towards the safety of the yen.

Helping somewhat to protect the downside for the currency pair is the potential for a currency intervention by the Bank of Japan, which has a consistent aim of curbing unwanted appreciation of the yen. But uncertainty remains as to how effective such an intervention may actually be and at what USD/JPY level an intervention might be initiated. In any event, intervention could have the effect of limiting an extensive rise in the yen (or drop in USD/JPY).

With equity markets showing signs of increasing stability recently, USD/JPY could resume its rebound off the noted double-bottom lows, with the next major upside target at the key 116.00 resistance level, which is near where the 50-day moving average is currently situated.

However, any significant return of turmoil or high volatility in stocks could very easily lead to another major plunge for USD/JPY. Tuesday’s price action showed a hint of this, as the currency pair fell substantially on a relatively moderate drop in equities. With any breakdown below the noted 111.00 double-bottom low, which would confirm a continuation of the medium-term downtrend, the next major targets to the downside reside at the 110.00 and then 108.00 support objectives.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.