![]()

The current surge in EUR/USD may have been somewhat difficult to imagine just a few months ago when it seemed that most market participants had a strong bearish outlook for the currency pair. That bearish bias stemmed logically from the argument that the prevailing monetary policy stances between the European Central Bank (ECB) and the US Federal Reserve remained highly divergent, with a consistently dovish ECB pressuring the euro and an increasingly hawkish Fed supporting the dollar.

Fast forward to February of 2016, and the dynamics for at least one side of this currency pair have shifted dramatically. Now, with the Fed not only unsure about further interest rate hikes but also potentially entertaining the possibility of rate cuts and negative interest rates on the hazy horizon, the previously-rising US dollar has made an abrupt U-turn.

The Fed’s progressively more dovish trajectory since December’s long-anticipated rate hike has recently begun to weigh heavily on the US dollar and has been the primary driver of EUR/USD’s sharp surge in February thus far.

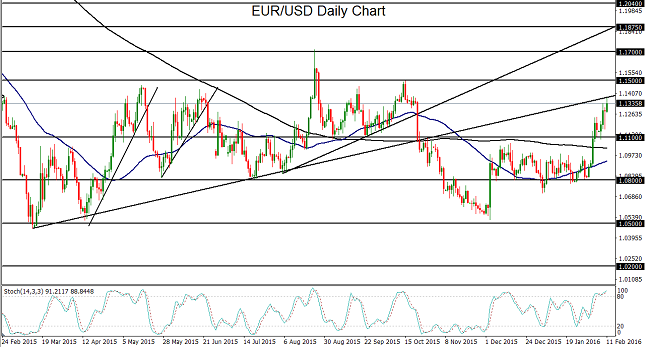

Whereas the months of December and January saw the currency pair consolidate within a tight trading range just above the key 1.0800 support level, the arrival of February brought increased concerns over turbulent financial markets, plunging crude oil prices, and slowing economic growth on a global basis. In turn, these concerns severely dampened speculation over future Fed rate hikes and led to broad-based dollar-selling.

This has been manifested as a strong surge in the EUR/USD that broke out above the key 1.1100 resistance level, and then followed-through to the upside to rise well above 1.1300 as of Thursday.

As the probability of further rate hikes by the Fed in the foreseeable future continues to diminish, the dollar could continue to undergo increased selling pressure, which could propel EUR/USD further up towards major resistance areas around 1.1500 and then 1.1700. To the downside, any sustained move back below 1.1100 support (previous resistance) would be a significant bearish indication that would invalidate the recent upside breakout.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.