After spending Monday paring some of its losses from last week, USD/CAD renewed its plunge on Tuesday as crude oil rebounded due to hopes for an output restraint deal among oil-producing nations led by OPEC.

With Canada’s economy heavily reliant upon exports of crude oil and oil products, the Canadian dollar’s value generally rises and falls, but has primarily fallen as of late, with the movement of crude oil prices.

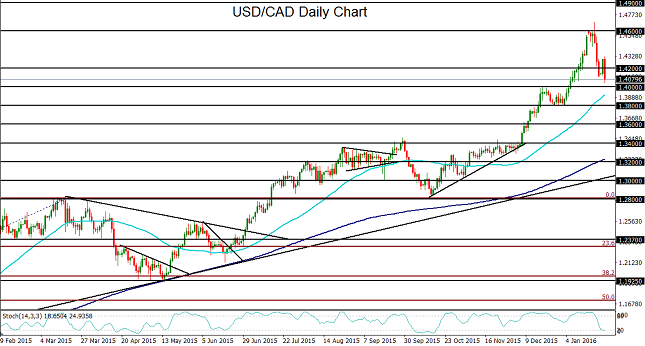

Prior to last week, Canada’s currency had been falling precipitously against the US dollar largely due to its correlation with crude oil, spurring a rapid rise for USD/CAD within the past several months. This rise reached its upside resistance target at 1.4600 before surging further to hit more than a 12-year high at 1.4688.

This rise was interrupted abruptly last week when the technically well-overbought currency pair made a sharp pullback from its highs as oil prices managed a modest rebound.

This week, although crude oil on Monday gave back a good portion of last week’s gains, prompting a bounce for USD/CAD, Tuesday saw a different turn of events. As noted above, hopes for a deal that could provide for coordinated restraint on oil output by both OPEC and non-OPEC nations, caused crude oil benchmarks to surge once again and USD/CAD to extend its recent pullback further towards 1.4000 on Tuesday.

Despite this talk of a possible output deal among oil-producing nations, an agreement of this nature should be exceptionally difficult to reach, given the political differences among many of these nations as well as the objective of all potential participants to protect and even expand market share. Furthermore, even if any semblance of a deal is reached, persistent concerns over waning global demand, particularly in China, could continue to pressure oil prices.

Based on a fundamentally bearish outlook for crude oil, USD/CAD’s current pullback, though significant, could well be limited. Without a bona fide recovery in crude oil prices, which continues to be unlikely, the Canadian dollar should remain challenged and pressured.

Currently, USD/CAD’s pullback has closely approached key support around the 1.4000 psychological level. Any turn to the upside on further weakness in crude oil could result in a move back up towards the original 1.4600 target. A breakout above the noted highs could then begin to target the 1.4900 resistance level.

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.