USD/CAD pulled back sharply on Thursday as crude oil staged a bounce from extreme multi-year lows and the markets digested the Bank of Canada’s decision a day earlier to keep its key interest rate unchanged at 0.5%.

Thursday’s surge in crude oil prices helped provide a boost for the long-battered Canadian dollar, which is closely linked to crude prices due to Canada’s reliance on oil exports. Crude oil’s bounce from 12-year lows on Thursday was prompted in part by a large, unexpected draw in distillate (diesel fuel and fuel oil) inventories, despite a greater-than-expected build in crude oil and gasoline inventories, as reported by the US government’s Energy Information Administration.

Besides this relief rally for crude oil, the USD/CAD pullback was also helped along by the Bank of Canada’s decision on Wednesday to keep interest rates unchanged despite some prior expectations of a potential rate cut in reaction to persistently low oil prices along with weak inflation and economic growth concerns. Furthermore, conspicuously absent from the rate statement accompanying this decision was any mention or hint of future potential rate cuts. This less-dovish-than-expected statement along with unchanged interest rates lifted the Canadian dollar from its multi-year lows, placing substantial pressure on USD/CAD.

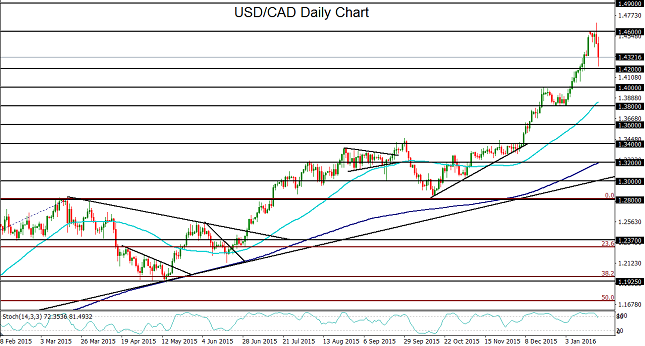

From a technical perspective, USD/CAD’s sharp run-up in the past weeks and months, but especially since the beginning of the year, led to a prolonged period when the currency pair had been technically well-overbought. After hitting and exceeding progressively higher upside targets at 1.4000, 1.4200, and most recently, a new 12-year high above 1.4600, USD/CAD had been in extremely overbought territory and due for at least a moderate pullback.

After failing to sustain trading above the 1.4600 resistance level, USD/CAD has currently pulled back down to re-approach the noted 1.4200 level, this time as support. While this pullback is unlikely to turn into a full blown reversal, due to fundamental forces that continue to support the currency pair over the longer-term, there could be further room for pullback, especially if crude oil continues to climb from its multi-year depths. In the event of a breakdown below the 1.4200 level, a major support target for the pullback is at the key 1.4000 psychological support level. From a longer perspective, however, the currency pair remains in a strong bullish trend. Any continuation of this uptrend above 1.4600 has a major upside target at the 1.4900 resistance level.

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.