![]()

Stocks reversed gains on Tuesday afternoon after having rallied in the morning. The morning rally was largely due to investors’ hopes for more central bank stimulus after China posted its slowest economic growth in years.

As global stocks pared gains, the Japanese yen, which had been losing traction due to the morning’s tentative stability in equities, began to rise in the afternoon as a risk-off sentiment took hold once again.

Also on Tuesday, Bank of England (BoE) Governor Mark Carney commented in a speech that there was no set timetable for hiking interest rates in the UK. This further added to the existing doubt surrounding the BoE’s monetary policy stance, and helped prompt the already-besieged British pound to plunge even further.

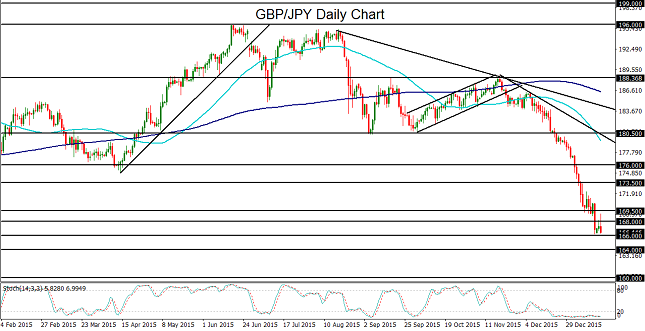

This combination of a falling pound and a late-rising yen pushed GBP/JPY back down to re-approach the key 166.00 support level, its lowest level in nearly two years. Prior to hitting this level, the currency pair had already been falling precipitously since early December, breaking down below progressively lower key support levels, including 180.50, 176.00, 173.50, and most recently, the 169.00 level.

As global economic concerns and low inflation continue to weigh on the Bank of England’s long-awaited intentions of raising interest rates, and bouts of equity market volatility continue to direct asset flows back towards the yen, GBP/JPY could have significantly more room to fall. On any sustained breakdown below the noted 166.00 support level, the next major downside targets are at the key 164.00 and then 160.00 support levels.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.