![]()

As my colleague Fawad Razaqzada noted earlier, another crash in Chinese equities has hit risk sentiment across the board, leading to a big safe haven bid as we move through Thursday’s US trading session. Unfortunately for GBP bulls, the pound appears to be one of the biggest casualties once again.

Economic data out of the UK was actually decent, if not particularly important, this morning: the country’s Halifax Bank of Scotland Home Price Index rose by a healthy 1.7% m/m, easily exceeding expectations of a 0.5% rise. Before you go popping champagne bottles though, note that this report is historically volatile on a month-by-month basis and housing prices are frankly not something traders are watching closely right now anyway.

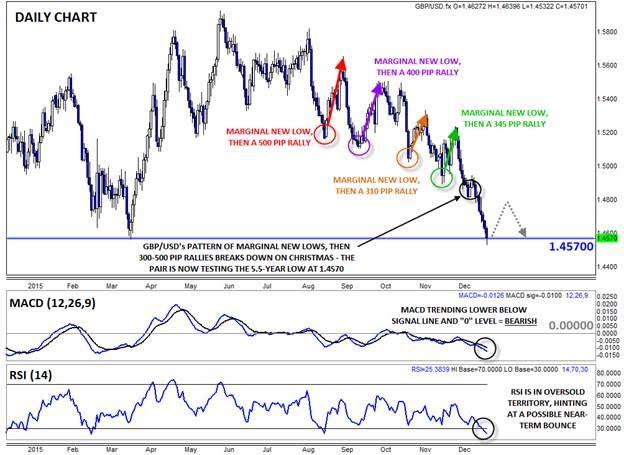

Indeed when it comes to GBP/USD, it feels as if traders are only focused on the recent downtrend. For months, we’ve been highlighting the long-term rounded top pattern that formed over the second half of 2015. Throughout that period, GBP/USD traded in a consistent pattern, dropping to a marginal new low before rallying 300-500 pips to just below the most recent high and rolling over to set a new marginal low once again.

That pattern broke down heading into the holidays a few weeks ago, when GBP/USD made a new low, but only saw a lackluster 140 pip rally heading into Christmas. Since then, the pair has sold off for seven consecutive days, and a close near current levels would mark the eighth. Earlier today, the unit peeked below the 1.4570 to hit a fresh 5.5-year low, though rates have since tracked back to that key support level.

Not surprisingly, the MACD indicator is trending lower below both its signal line and the “0†level, showing strong bearish momentum, though the RSI is in oversold territory at 25. While a bounce off the key support level at 1.4570 is a definite possibility (especially if tomorrow’s Non-Farm Payrolls report prints below 200k jobs – stay tuned for more on NFP in our full preview report later today), the medium-term trend will remain to the downside as long as GBP/USD holds below the Christmas high at 1.4950. Meanwhile, if the 1.4570 floor conclusively gives way, bears could look to target the mid-2010 lows in the 1.4200-1.4300 zone next.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD trades on a stronger note 1.2530, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The United States Employment report will be released by the Bureau of Labor Statistics at 12:30 GMT. The US Dollar looks to employment data after the Fed signaled its intention to hold rates higher for longer on Wednesday.