![]()

The white-knuckle roller coaster ride that is this week’s markets continues today. Equities rallied across the board, with European indices rising 3+% and US bourses tracking about 1% higher as of writing. Yields in the US, UK, Germany, and Japan are all ticking higher today, showing modest selling of safe-haven bonds across the globe (this same sentiment is reflected in gold’s lackluster trade today). Meanwhile, oil prices have exploded higher today, with the benchmark WTI contract exploding higher by over three points, or nearly 9%, on the day.

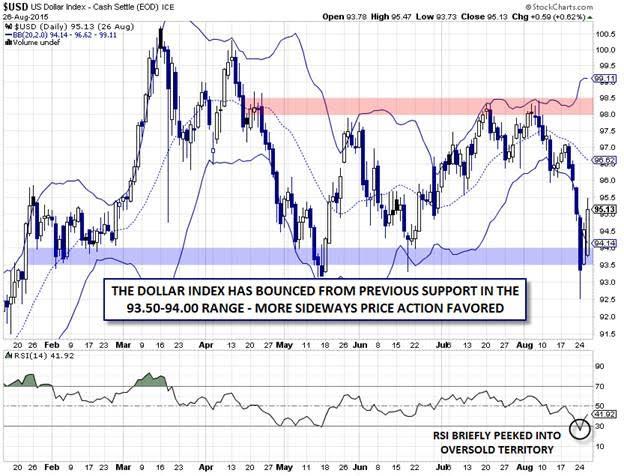

So with oil and stocks surging and bonds falling, surely we’d expect the dollar to be on the back foot as well? Well, no; in fact, the dollar index is actually trading up about 0.5% on the day, after a big gain yesterday as well. In many ways, today’s (and yesterday’s) price action is merely unwinding some of the panic-driven moves we saw earlier this week. In that context, it’s not surprising to see the dollar rally sharply in an attempt to dig itself out of its recent hole.

Taking a step back reveals another reason why the dollar has seen a short-term bounce: the pair found a floor directly at previous support in the 93.50-94.00 range. This zone has consistently marked near-term bottoms in the index since early February, so it’s not surprising that bulls stepped in to defend that level once again. Looking beyond the price action itself, there were deep oversold readings in both the Bollinger Bands (price below the lower 2sd band) and RSI indicator (below 30). Given the previous support level and clear oversold readings, the recent rally in the greenback can be chalked up to nothing more than an oversold bounce thus far.

So what are the key levels to watch in the dollar index (and by extension, EUR/USD) moving forward? To the topside, the key level to watch will be in the 98.00-98.50 zone, which has served as resistance for the past four months. Only if price can break that key barrier will bulls feel comfortable declaring that the uptrend has resumed.

For now, the US dollar remains trapped in a sideways range against its major rivals as traders try to decipher the Fed’s intentions…and whether a rate hike would even be beneficial for the dollar.

Source: Stockcharts.com & FOREX.com. Note that this chart does not yet reflect today’s price action; the dollar index is trading at 95.63 as of writing.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.