![]()

“We’re all Keynseians now” – Milton Friedman

The above quote is often misattributed to US President Richard Nixon, when he closed the gold convertibility window. Regardless, the phrase “We are all _____ now” has since become part of the lexicon for anyone trying to make a broad generalization about the current zeitgeist.

Amidst the recent global market turmoil, I’d like to postulate that “We are all USD/JPY traders now.” That’s because USD/JPY has become the de facto measure of risk appetite of late, leading to correlated moves in equities, commodities, bonds, and even other currency pairs. The most salient short-term example of this phenomenon is the recent roller coaster ride in US equities.

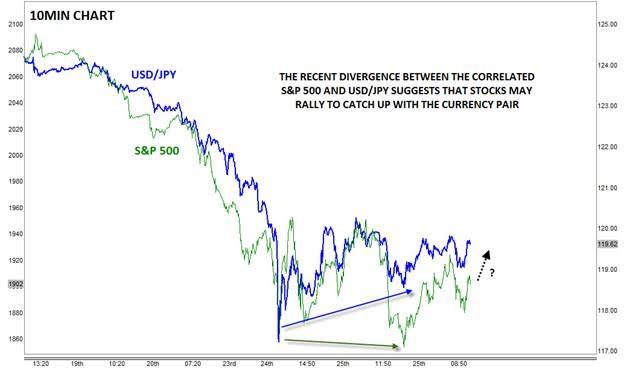

Both USD/JPY and the S&P 500 began to sell off in earnest last Thursday, with the drop accelerating until the absolute panic bottom on Monday morning. From there, the two instruments rallied back to regain some of the previous losses by midday Tuesday before turning sharply lower once again. Both USD/JPY and the S&P 500 bottom ahead of today’s Asian session and have chopped around in volatile ranges so far today.

For day traders, it’s worth noting that USD/JPY has formed its intraday tops and bottoms slightly ahead of the US stock market index; furthermore, USD/JPY has gone on to set higher lows since Monday’s panic bottom, whereas the S&P 500 hit a minor lower low last night. The currency pair’s current bullish divergence with US stocks suggests that we could see an equity rally in the short term (in other words, the green line on the chart below may “catch up” to meet the blue line), which could create the widely-awaited oversold bounce.

That said, if you share my colleague Fawad Razaqzada’s longer-term concerns about USD/JPY, it could also bode ill for global stocks. As we noted yesterday this week’s massive drop has done plenty of technical and psychological damage, and the pervasive “buy the dip” mentality that has characterized the past four years has been broken.

One way or another though it looks like “We’re all USD/JPY traders now.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.