![]()

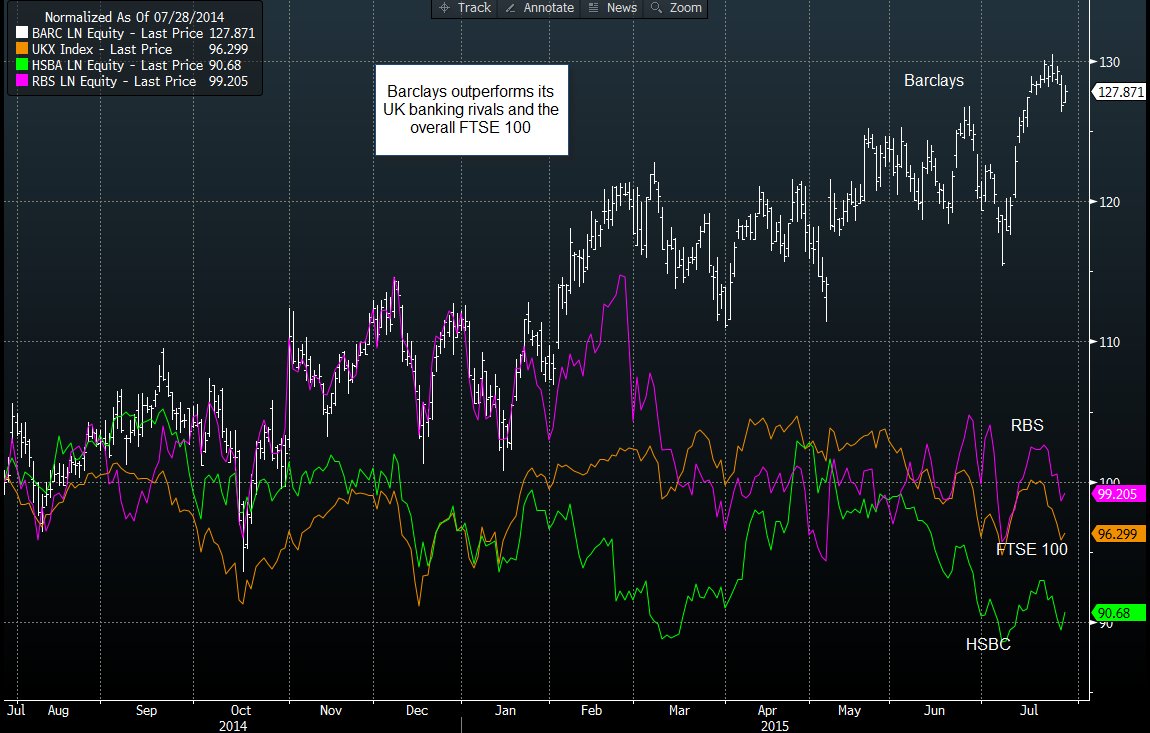

The chart below shows a funny phenomenon in the UK banking world. Barclays, the former bad boy of the financial sector and fine-payer extraordinaire, has turned a corner, at least that’s what its stock price is telling us. Ahead of its first earnings release since the departure of its conservative and retail-focused CEO Anthony Jenkins, Barclays has been outperforming its rivals including HSBC and RBS, and has also outperformed the overall FTSE 100 by a sizeable margin, as you can see in the chart below.

Figure 1 has been normalised to show how these companies move together, and, as you can see, Barclays has been outperforming since October last year. However, the real divergence happened earlier this year in April, when the FTSE 100 peaked, yet Barclays continued to move higher. This also marked the high in HSBC and RBS has pretty much been trading sideways since a sharp fall in February.

Barclays has managed to maintain its dominance in the face of a dramatic exit of its CEO and a strategy shift from a conservative, retail-focused banking business towards the higher risk investment banking of yester-year. Interestingly, this extreme shift in strategy hasn’t stopped Barclays from dominating banking stocks so far this year.

Why is Barclays outperforming?

We believe there are a few reasons:

The “bad news” – fines, bashing by the government - is considered yesterday’s news for Barclays. Thus, with a permanent new CEO likely to be announced in the coming months, it appears that the slate has been wiped clean.

In contrast, some of Barclays’ rivals are still coming under pressure. HSBC has threatened to leave the UK in favour of Asia as a boycott of the bank levy. However, the recent gyrations in the Chinese stock market makes this move look questionable at this stage.

RBS and Lloyds are burdened by the government who continue to hold a sizeable stake in both banks, particularly in RBS where its stake remains close to 80%. This could limit their potential and stop them from moving back into higher risk areas like investment banking, which could give Barclays a crucial head start on its rivals.

So, while its rivals decide on things like where to locate its head-quarters and how to placate its government stakeholders, Barclays could stay ahead of the pack and return to riskier business practices after years of having to play it safe post the financial crisis. This was the main reason why CEO Jenkins stepped down earlier this year, and the market has given this shift in focus its seal of approval. Due to this, we think that Barclays may continue to outperform for the foreseeable future, even if we see further declines in the broader FTSE 100 index.

Wednesday’s Q2 earnings may determine the short-term direction of Barclays’ share price, the market is looking for an EPS of 0.06. This seems fairly low, considering that RBS is expected to report an EPS of 0.07. If Barclays’ earnings does slip compared to its peers then we may expect some weakness in the stock price, however, the medium-term direction could be dependent on the tone of the comments coming from Barclays’ high command. Any more detail on the shift towards a higher-risk strategy may continue to be rewarded by the market.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.