![]()

Today was supposed to be the deadline for Iran and the P5+1 to reach a final agreement that would have limited Tehran’s nuclear programme in return for lifting its sanctions. However, it doesn’t appear as though anything will be agreed upon in time for the deadline, though the meetings are likely to continue for several more days nonetheless. Apparently there are several issues that stand in the way of an agreement, including the rights of nuclear inspectors entering military sites in Iran and that in the event of a deal, differences of opinion remain on the speed and timing of lifting the sanctions. Oil speculators who had opened some bearish positions in preparation for today’s deadline are probably trimming those positions, which could be one of the factors boosting Brent prices today. Needless to say, the oil market remains more than sufficiently supplied. If Iran were allowed to add to the excess, it is very likely that prices will have to fall and fall significantly.

Indeed, positioning data from the ICE, published on Monday, does suggest that the market is growing worried about a fall in oil prices as money managers withdrew from Brent for the seventh consecutive week. In the week to June 23, net long positions in the London-based oil contract fell by an additional 1,500 to 193,800 contracts. Net longs have now almost fallen 35% since hitting a record high in early May. Further sharp withdrawal of bullish positions from this group of market participant could really get the ball rolling.

As well as talks over Iran’s nuclear programme, the near term focus will now be on the latest US crude oil inventories data. Stockpiles are seen falling for the ninth consecutive week, this time by 4.9 million barrels. The American Petroleum institute (API)’s report will come ahead of the official data from the US Energy Information Administration (EIA) tomorrow afternoon.

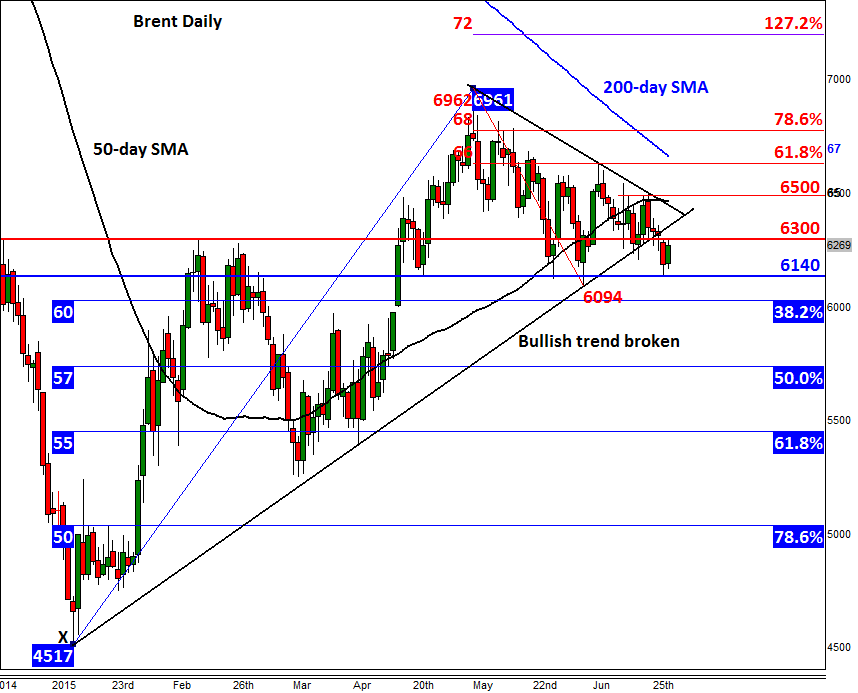

Technical outlook: Brent has broken uptrend

As we reported on Friday of last week, Brent’s upward sloping trend line was “looking shaky.†We mentioned that given the current fundamental backdrops, we wouldn’t be surprised if it broke down “even before we hear anything on Iran.†Indeed, this is exactly what has happened, with price also hitting our initial target and support at $61.40, before bouncing back. Brent is now testing the old support around $63.00. Given that the bullish trend has already been broken, this level could now turn into resistance – though a closing break above it could see price make a move towards the bearish trend at $64.50. As things stand, we remain bearish on Brent for as long as the bears defend the $65.00 resistance level. The next bearish target could be this month’s low of just below $61.00. Below $61.00 are the Fibonacci retracement levels at $60.30 (38.2%), $57.40 (50%) and then $54.50 (61.8%).

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.