![]()

The EUR/USD surged higher today, rallying some 275 pips from its low to the high before easing off just ahead of the 1.1200 handle. The rally was fuelled first and foremost by speculation about Greece. Following late night talks in Berlin, the Greek PM Alexis Tsipras tweeted that they have submitted a “realistic plan for an agreement…” and that “it is now up to the political leadership of Europe to decide.” Likewise, Greece’s creditors were reported to have reached a consensus on the terms of a proposed deal to put forward to the Greek government, according to the WSJ. Although a deal looks imminent now, there are still some big hurdles to clear. Once the plan has been agreed upon, the Eurozone finance ministers will need to sign it off. With the next scheduled Eurogroup meeting being on June 18, the actual disbursement of the €7.2 billion bailout funds may therefore take some time yet. Nevertheless, that would be the least of the Greek government and market’s worries. With the euro already gaining this much ground, the potential announcement of the news may not lead to an automatic rally. Indeed, I wouldn’t be surprised if traders “sold the news” as evidently they are already buying the rumour.

Meanwhile there have also been some actual fundamental reasons supporting the euro beside speculation over Greece. This morning saw inflation in the euro zone rise for the first time in six months. The headline CPI for the month of April showed a reading of 0.3% year-over-year versus 0.2% expected. Core CPI was up a good +0.9% versus +0.6% previously. We also had some decent employment numbers out of Spain and Germany. The number of unemployed Spaniards fell by a good 118,000 while in Germany the decline was a modest 6,000 month-over-month. Clearly, the ECB’s record low interest rates and the huge bond buying stimulus programme are having the intended impact on the euro zone economy. However it is still too early for the ECB to turn hawkish, although any suggestions on Wednesday by Mario Draghi about an earlier-than-planned end of QE could see the euro surge even higher. Also aiding the EUR/USD rally today has been the release of some soft economic data out of the world’s largest economy. US factory orders surprisingly fell by 0.4% month-over-month in April while the IBD/TIPP Economic Optimism unexpectedly dropped to 48.1 from 49.7 in May. There will obviously be a lot more important US macro pointers to look out for later in the week, which means the EUR/USD volatility – and trade opportunities – could increase even further.

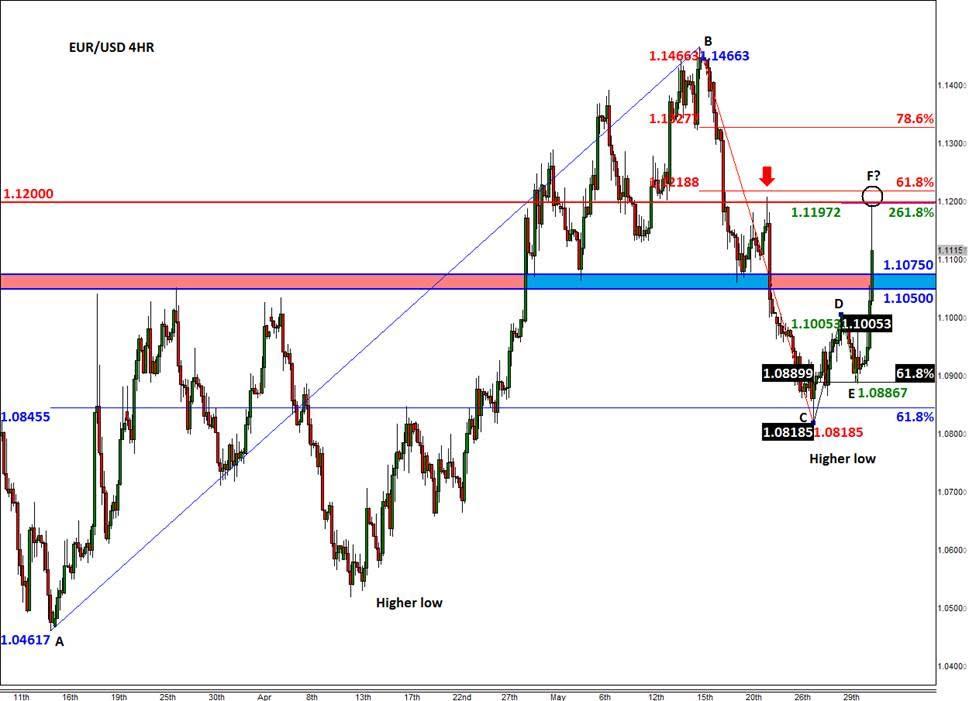

From a technical point of view, the moves in the EUR/USD look very interesting. As can be seen on the chart, the 61.8% Fibonacci level has once again proved to be very important in determining the direction. The downswing from the May high of 1.1466 ended around the 61.8% retracement of the upswing from March low, around 1.0845.The bounce from here lost steam around point D at 1.1005, but the corresponding sell-off once again came to a halt at the 61.8% Fibonacci level (point E). Evidently, traders have been buying the dip. Today’s break above 1.1005 momentarily faded at the 1.1050/75 resistance area, but such was the strength of the breakout that price spike through this area shortly afterwards. Clearly, some weaker hands were taken out in this short squeeze rally, which probably added further fuel to the move.

Going forward, traders will want to watch the area around 1.1200 with keen interest as this is the next key area of resistance. As well as the prior high, the 61.8% Fibonacci retracement of the downward move from the May high (i.e. the BC swing) converges with the 261.8% extension of the DE swing. Given that price spiked close enough to this area earlier, it could be that the EUR/USD may have already peaked for the time being. Nevertheless, further gains could be on the way if the buyers now step in to defend the broken resistance area between 1.1050 and 1.1075. A potential break below this area would thus be a bearish outcome.

Figure 1:

Source: FOREX.com.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.