![]()

Background:

Traders often refer the impact of ‘month end flows’ on different currency pairs during the last few days of the month. In essence, these money ‘flows’ are caused by global fund managers and investors rebalancing their currency exposure based on market movements over the last month. For example, if the value of one country’s equity and bond markets increases, these fund managers typically look to sell or hedge their now-elevated exposure to that country’s currency and rebalance their risk back to an underperforming country’s currency. More severe monthly changes in a country’s asset valuations lead to larger portfolio adjustments between different currencies.

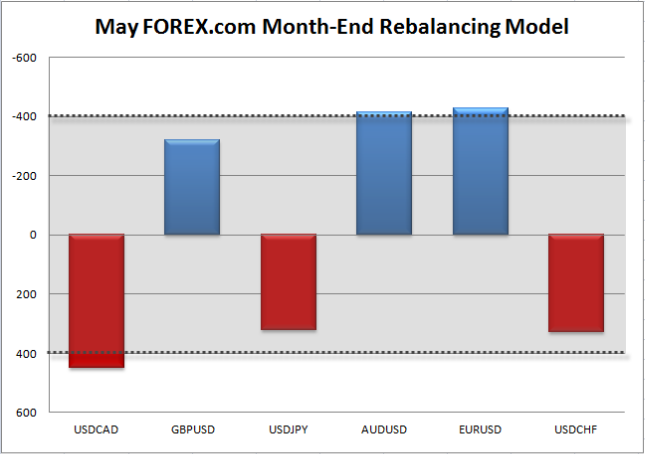

In order to predict these flows and how they impact FX traders, we’ve developed a model that compares monthly changes in the total value of asset markets in various countries. In our model, a relative shift of $400B between countries over the course of a month is seen as the threshold for a meaningful move, whereas monthly changes of less than $400B are often overwhelmed by other fundamental or technical factors. As a final note, the largest impact from month-end flows is typically seen heading into the 11am ET fix (often in the hour from 10 & 11am ET) as portfolio managers scramble to hedge their overall portfolio ahead of the European market close.

As we stand on the precipice of a new month, it’s easy to look back and retroactively explain the trends and themes of May: Of course the dollar would resume its longer-term rally, the euro would be hit by fears surrounding Greece’s debt, the UK would fall into deflation, USDJPY would break out from its unsustainably tight range and the commodity dollars would fall in sync with the rising US dollar. The problem is that we must live life looking out the windshield, not the rear view mirror.

Peering through the fog of the future, one immediate move we may see is a bout of US dollar weakness heading into the official end of this month this weekend. US bourses generally rose over the course of the month (the NASDAQ in particular tacked on over 3%), while most European and Asian indices were essentially unchanged (two exceptions: Spain’s IBEX index edged lower in May, while Japan’s Nikkei index rose over 1,000 points). In fixed income, bond yields rose sharply across the world, with the biggest relative move in Germany’s DAX index.

Given the slight outperformance of US equities, our model shows that global portfolio managers will have to sell US investments and buy other assets to rebalance back to their target allocations. As a result, we could see a bit of dollar weakness over the course of today’s trade, with EURUSD, AUDUSD, and USDCAD all reaching the +/- $400B threshold for a significant move in our model. The dollar selling, if seen, is expected to be more limited in GBPUSD, USDJPY, and USDCHF as a result of the smaller relative shifts between those countries’ asset markets.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.