![]()

US dollar bulls took one on the chin this morning with the release of the April ADP Non-Farm employment report. While not as widely-watched as the Friday’s marquee NFP report from the BLS, ADP’s report can still provide an accurate view of the health of the labor market, and based on this morning’s release, it looks like the labor market may be coming down with a bug.

The report showed just 169k net new jobs created in April, below the 199k reading expected by traders and economists; this marked the fourth consecutive miss in the report. Adding insult to injury, the last month’s reading was also revised down by 14k to just 175k. Dollar bulls, as well as the Federal Reserve, are anxiously watching for a spring thaw in economic data and today’s disappointing data further raises the stakes for Friday’s NFP report.

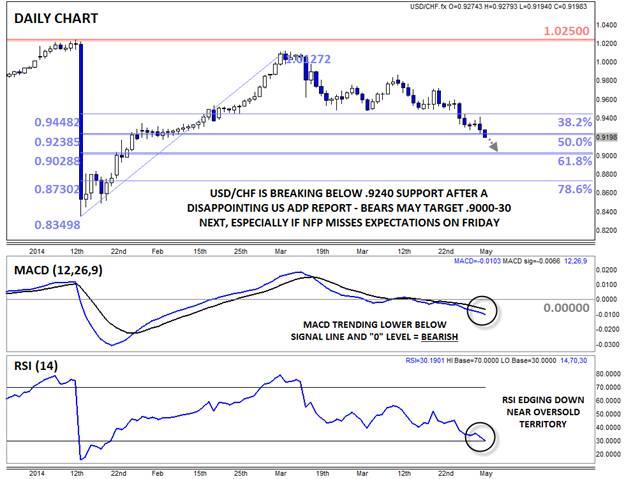

Technical View: USDCHF

Turning our attention to the chart of USDCHF, the pair is edging below key support at .9240 (the 50% Fibonacci retracement of the post-SNB rally) as of writing. Yesterday, rates carved out a Bearish Engulfing Candle*, signaling a clear shift to selling pressure that has now gained strength from the disappointing ADP report and break below support. Meanwhile, the MACD is trending lower beneath its signal line and the “0” level, showing clearly bearish momentum, though with the RSI indicator is approaching oversold levels for the first time since the SNB debacle, the bearish trade may be getting a bit crowded in the short term.

Assuming USDCHF manages to close below the .9240 level, a continuation lower will be favored heading into the weekend. If we see a weak NFP report confirm today’s ADP data, USDCHF bears could seek to push the pair down to the next level of Fibonacci retracement support at .9030, which conveniently comes in near the psychologically-significant .9000 level. At this point, only a break back above previous-support-turned-resistance around .9240-50 would put the bearish bias on hold.

*A Bearish Engulfing candle is formed when the candle breaks above the high of the previous time period before sellers step in and push rates down to close below the low of the previous time period. It indicates that the sellers have wrested control of the market from the buyers.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.