![]()

Currency markets are off to a relatively slow start to the week, with the dollar generally inching lower vs. its major G10 counterparts. While not the focus of today’s report, it is worth noting that the trade-weighted dollar index is inching below its 50-day moving average at 97.00, suggesting that a deeper dip could be in the cards as we head into May. Speaking of May, many European banks will be closed on Friday for the May Day holiday, meaning that market liquidity could be more subdued than usual heading into the last trading day of the week.

Of course, “mayday” is also an international distress call used to signal a life-threatening emergency and while trading isn’t a life-and-death endeavor (though it does feel like it sometimes!), there are still ample opportunities for both bulls and bears alike to panic. Below, we zero in on two situations that could prompt some EM FX traders to call “mayday” this week:

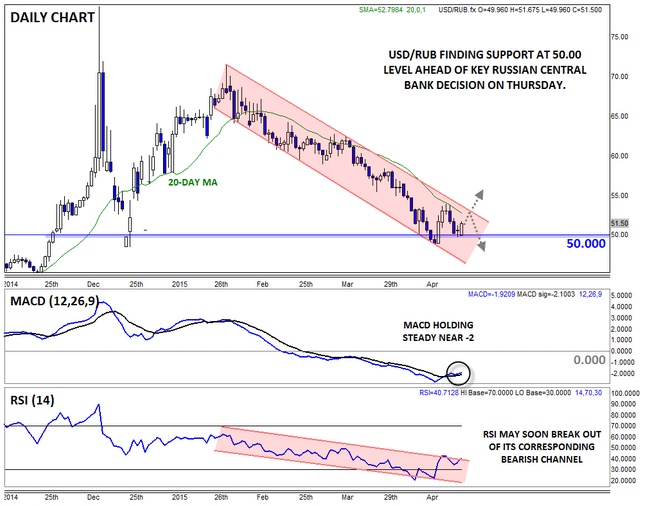

1) USDRUB Downside Momentum Stalling?

In last week’s EM Rundown, we highlighted the potential for USDRUB to test the top of its channel and 20-day MA resistance near 54.00. As it turns out, the volatile currency pair was rejected from the barrier, fell back down to test 50.00, and is now edging back higher off that key level. From a technical perspective, the bias will remain lower as long as resistance at 54.00 holds, but bears will be hesitant to commit too strongly with buyers consistently defending resistance at the 50 level.

From a fundamental perspective, Russia’s central bank faces a difficult interest rate decision on Thursday, with consensus estimates calling for a 100bps cut amidst a dramatically strengthening ruble and still elevated inflation expectations; a larger-than-expected cut could reinvigorate the downtrend, while a decision to remain on hold could take USDRUB through channel resistance near 53.00.

Source: FOREX.com

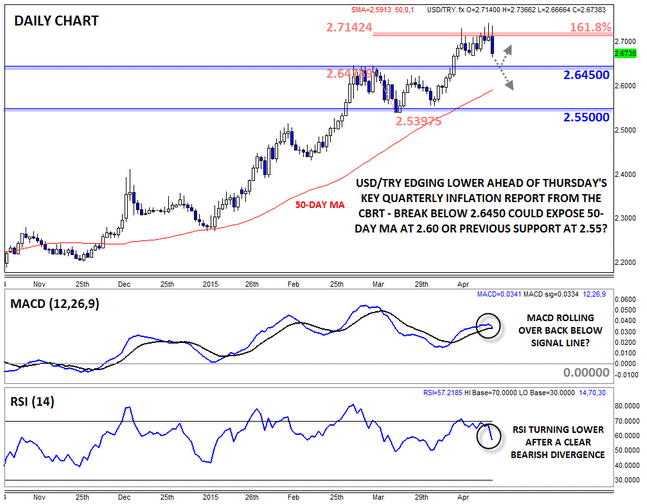

2) USDTRY Rolling Over off 2.70?

While the ruble managed to strengthen over the last few months, Turkey’s lira has continued to depreciate against the world’s reserve currency. USDTRY stalled out against its 161.8% Fibonacci extension at 2.7150 last week and after peeking above that level earlier today, the exchange rate has fallen all the way to a two-week low at 2.67 as of writing. At the same time, bearish divergences in both the MACD and RSI indicators are raising additional warning flags for bulls.

When it comes to the underlying economy, Turkey’s central bank will release its highly-anticipated Quarterly Inflation Report on Thursday. The lira has depreciated sharply since the last inflation report in January, so presumably the bank will be looking for inflation to exceed its previous forecast of 5.5%. That said, the line separating monetary policy and politics is a bit blurry in Turkey, so the central bank may opt to hold off on any interest rate hikes until after June’s big election.

Source: FOREX.com

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.