![]()

The positive feelings for Greece that started in early North American trade today continued throughout the second half of trade as the euro gained ground and the USD was the biggest loser. If the insinuation made by an anonymous Greek government official that an agreement between Greece and her debtors is indeed “very close”, EUR positivity may extend in to the weekend and continue to weigh on the USD as well. However, as we all are extremely familiar with by now, negotiations with Greece rarely proceed without at least some sort of intrigue, and those good feelings can turn bad in a hurry.

The unfortunate thing about the kind of Eurogroup meetings that will be going on tomorrow is that most of the news is transmitted via officials who say something to the press. This is one of the rare circumstances where the Second Undersecretary of Seed Development in Kerplakistan (or “anonymous source”) can move the EUR substantially in either direction. Therefore, much like that little catch-all thing at the bottom of your propane grill, you may want to avoid that grease trap; let someone else deal with it.

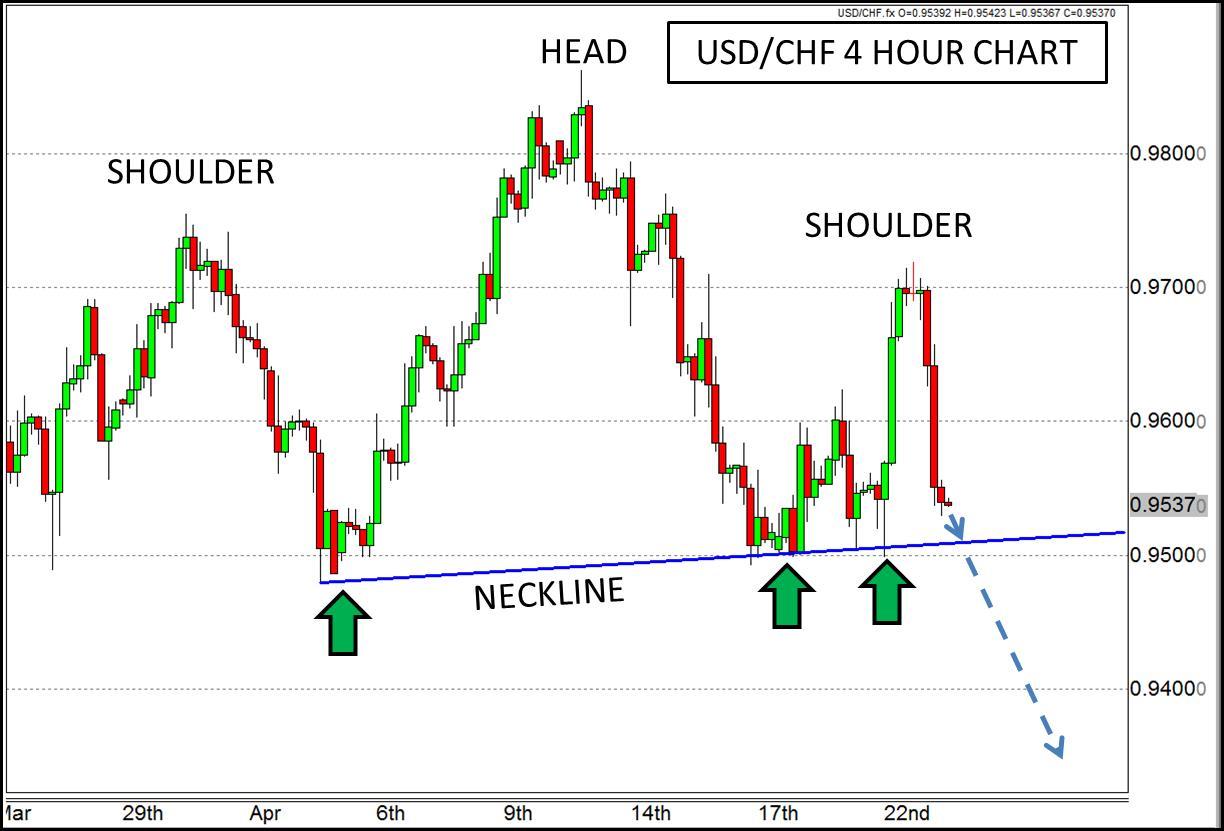

One attempt to avoid it could be in the USD/CHF which is currently carving out a Head and Shoulders pattern. If you were so inclined, you could make an argument that trading the USD/CHF to avoid the EUR is a bit shortsighted since the EUR/USD and the USD/CHF are essentially mirror images of one another, but I would counter that the previously correlated currency pairs aren’t as correlated after the Swiss National Bank dropped the peg in the EUR/CHF. The correlation is still there, to a degree, but it isn’t as pronounced as it used to be and the actions of the Eurogroup tomorrow may supersede that tendency.

A break below the neckline on this pair, near 0.95, could continue the USD weakening action we have seen in many of the major currency pairs over the last week. If the neckline were to give way, substantial support may not be found again until an area of previous support near 0.9350 which also corresponds with the 161.8% Fibonacci extension of the neckline to right shoulder.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.