![]()

What started out as a bit of a tug of war between USD bulls and bears in the morning session of North American trade, turned in to a mauling against the world’s reserve currency in the afternoon. The USD is suffering against all of its currency brethren as a combination of uninspiring data points and mixed messages from Federal Reserve voters is giving investors fits. All in all, it appears traders are anticipating the Fed to be more patient in their quest to raise interest rates as most of the voters are preaching data dependence; and data hasn’t been great.

If whether the Fed will raise interest rates or not was the only consideration for traders, life would be a whole heck of a lot easier, but that simply isn’t the case. Issues with Greece, the British election, Middle-Eastern skirmishes, and a Chinese slowdown are all additional factors that are weighing on the minds of traders, and can influence markets on a whim if they spring up.

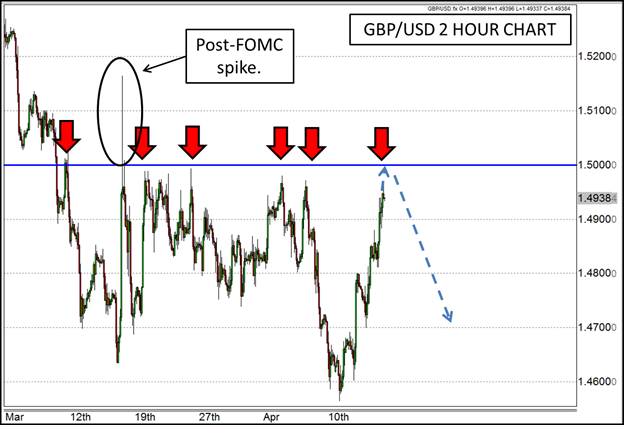

Therefore, even though the USD has been getting its tail kicked over the last few days, the tide can turn rather quickly, and all it might take is a blatant technical level for investors to pay attention. The GBP/USD is one currency pair in particular that could have such a revelation. Since mid-March the 1.50 level in this pair has been a virtual ceiling, turning away any attempts at advancement (outside of the post-FOMC spike), and this week’s rally back up to it may be yet another example in the series. Be cautious though as the UK will be releasing employment data which hasn’t missed consensus since the November 2014 release. If that streak continues, the GBP/USD may blast right through 1.50 and reestablish itself as a recovering asset.

Figure 1:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.