![]()

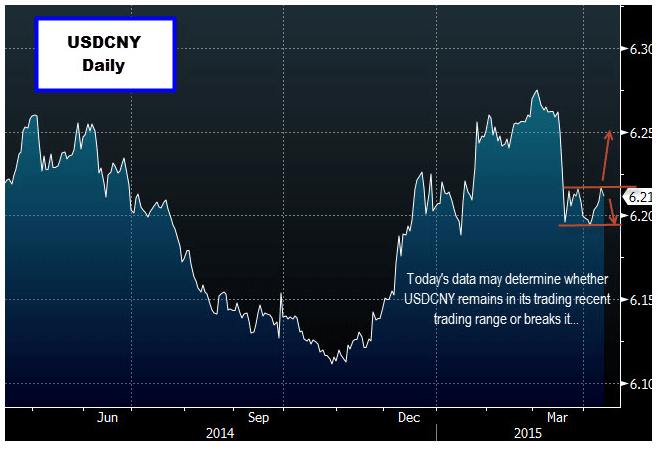

The yuan has been trading in a fairly tight range against the US dollar lately, as traders await more guidance from both sides of the Pacific. Both the US dollar and the yuan are consolidating after some big moves on the back of fundamental changes in their respective long-term outlooks.

For the US dollar, it was the prospect of tighter monetary policy in the US that led investors to snap up the world’s base currency. The next biggest economy in the world, China, is faced with the exact opposite scenario as the People’s Bank of China (PBoC) attempts to manage a planned economic slowdown. The resulting divergence of the monetary policies of the Fed and PBoC, combined with the latter’s desire to prove CNY isn’t a one-way trade, reversed a long standing downward push in USDCNY.

The next big thing for USDCNY is the release of China’s growth figures for Q1, which are expected to show that the economy grew at its slowest pace in six years. It’s not all bad though, the expected 7.0% y/y growth rate is in line with Beijing’s official target for this year and some other economic data released at the same time should show a rebound in retail sales and industrial production in the first month of this quarter.

However, the release of abysmal trade numbers for March on Monday leave the yuan exposed to softer than expected data today (0200GMT). Exports fell 15.0% in the year to March, completely missing an expected 9.0% gain. Imports also missed the mark at -12.7% y/y (exp. -10.0%), exasperating fears about the health of domestic demand. The yuan was largely able to brush aside these figures due to some questions about the accuracy of the data, but this may not save CNY today.

The market is already expecting the PBoC to cut interest rates and the RRR further in coming months and quarters, but softer than expected growth in Q1 may increase the likelihood of looser monetary policy in the near-term. Beijing is already concerned about a deteriorating property market, lacklustre domestic demand and, now, a softening export sector, and it won’t hesitate to act if growth is threatened further.

Other Chinese economic data due today at 0200GMT:

- Retail sales – exp. 10.9% y/y

- Industrial production – exp. 7.0% y/y

- Fixed asset ex. rural – exp. 13.9% YTD y/y

Source: FOREX.com (note this is a Bloomberg chart and may not represent the prices offered by FOREX.com)

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.