![]()

The end of April Fool’s Day in North America was rather tepid even though both US equity markets as well as the USD tried to battle back from early declines. Stocks ended up down on the day despite that puncher’s mentality, but were well off the lows established in early trade. The USD as well shook off early weakness and found support in currencies like the USD/JPY around previous established price levels, but an overwhelming rally was lacking. As we careen in to the back half of this short week, liquidity is likely to get lighter as investors have spring break and Easter holiday on their minds more than price breaks and Greek loan payment holidays.

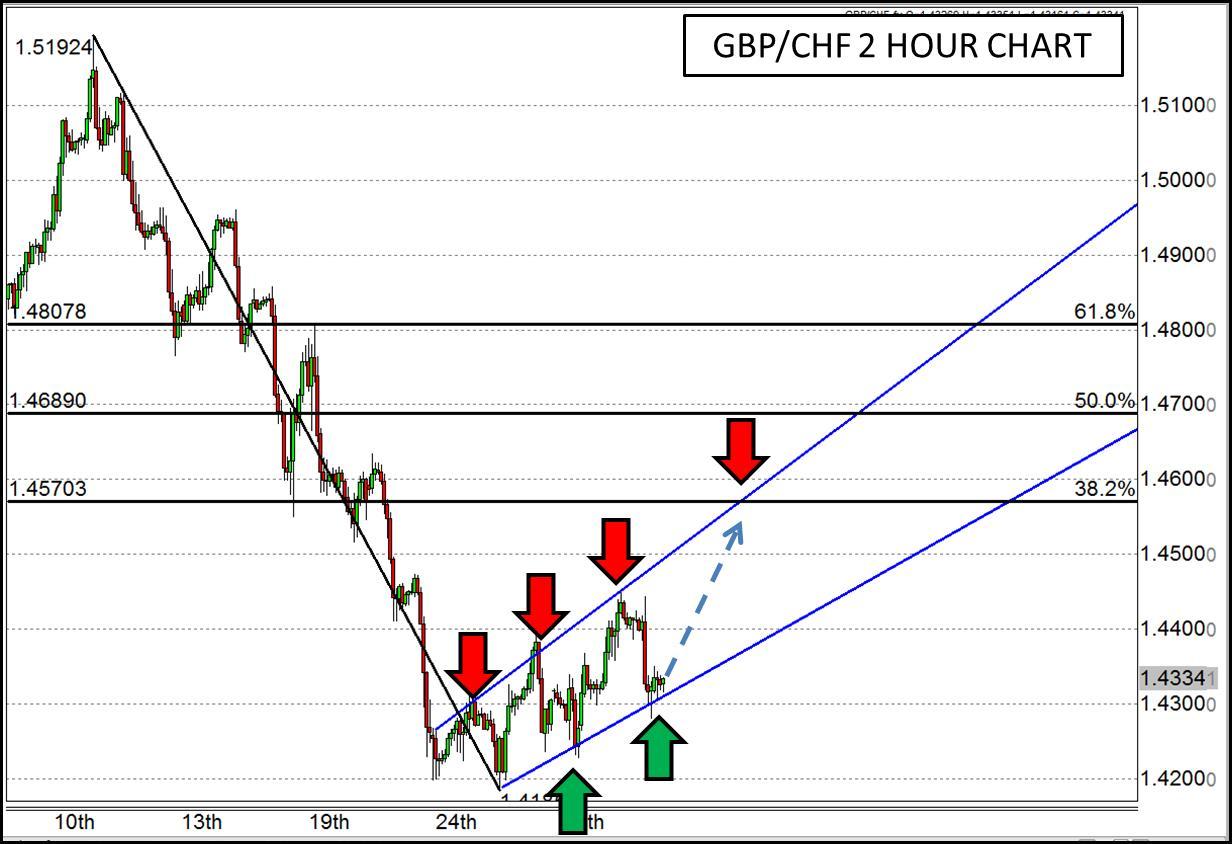

Despite the thin trading conditions likely to manifest over the next couple days, there are some intriguing possible moves beginning to set up; and one such move could be in the GBP/CHF. The GBP has been eviscerated over the last month against many other currencies mainly, it seems, on the fact that so much has been expected of it. Granted, inflation hasn’t been stellar and the unemployment rate ticked up from 5.6% to 5.7%, but other than that, economic figures haven’t been particularly dour. Most of the PMI figures are strong, borrowing is up, sales on the retail side are increasing with conviction, and even the final GDP release was revised higher for Q4. Perhaps some of this GBP bashing will come to an end and reverse some of the negative trends we’ve seen for the currency.

The GBP/CHF is an intriguing pair due to a potential changing of that downward trend. In the month of March, when this pair fell from nearly 1.52 down to 1.42, it followed a relatively tight channel on the way, but the end of the month and the beginning of the new month has revealed that a new channel could be developing in the opposite direction. Extrapolating Fibonacci retracements from the March high to low shows that there may be room for a run up to 1.46, 1.47, or even 1.48 if it were to rise at the pace of the currently developing channel. Being that prices are near the bottom of the new channel currently, the time is nigh to test this theory and see if the GBP can get some spring in its step and blaze a new trail higher.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.