![]()

The second half of North American trade was notably more somber this afternoon as the world became aware of the events leading up to the Germanwings plane crash earlier this week. While financially important events, like speeches by central bankers, were happening, they all seemed to fade in to the background as more important societal elements were the main topic of discussion. Amidst all this contemplation of human depravity, US equity markets maintained their early momentum and steadily rose throughout the day, commodities were mixed, and the USD tried to remember what it was like to be the most dominant currency on the planet.

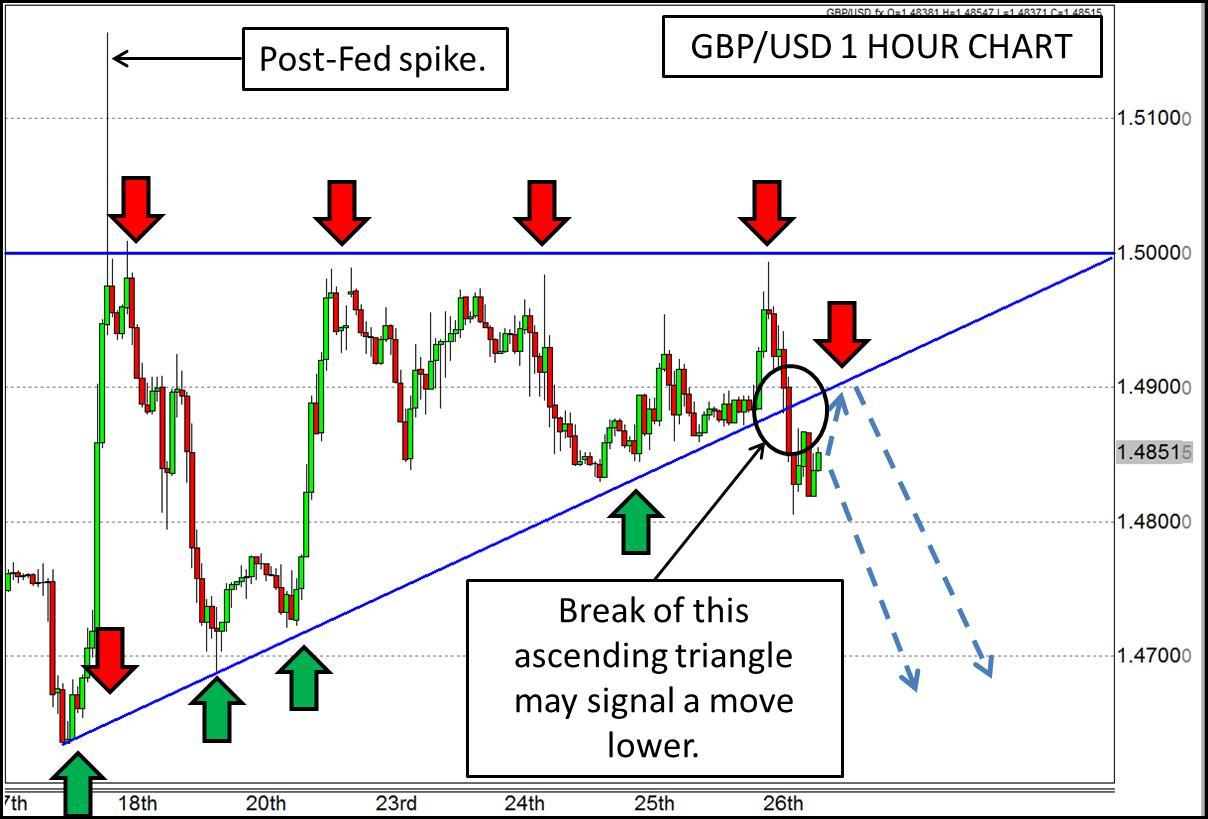

One currency against which the USD fared well was the GBP. The UK actually had some pretty decent economic figures released this morning before the US open. UK Retail Sales rose 0.7% which beat consensus, and the previous figure was revised upward as well, plus CBI Realized Sales also rose more than anticipated. However, once US data came out, which was also generally better than consensus, the GBP/USD began a move lower that erased nearly 200 pips of progress since last week. The move lower also broke below a rising trend line that helped form an ascending triangle prime for a breakout to the topside; however, considering the pattern couldn’t be maintained, the case for a move lower may be more compelling as the USD could go back to being King Dollar.

While we can’t completely rule out the potential for this pair to flip the script and break the 1.50 level as we head in to the weekend, it is looking evermore unlikely. Outside of the immediate post-Federal Reserve move, this pair hasn’t been able to advance beyond that imaginary Maginot Line, and it may now have help keeping this pair capped with the previous rising trend line support turned resistance.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.