![]()

Prior to the release of the latest crude supply data from the Energy Information Administration (EIA), WTI was higher on the day and for a time it was trading above $51 a barrel. Speculators were hoping that the recent trend of sharp increases in oil inventories would come to end after the American Petroleum Institute’s (API) stockpiles report last night had shown ‘only’ a 2.9 million increase in US oil inventories. The consensus forecast for the official report from the EIA was a moderate build of 4 million barrels for the week ending February 27.

However, the actual build was significantly higher than expected once again, this time to the tune of 10.3 million barrels. Stocks at Cushing, the delivery point for WTI contract, increased by 2.4 million barrels. The change in supply of crude products was mixed, with distillates decreasing a tad and motor gasoline being unchanged from last week.

The EIA data therefore suggests that oil companies are continuing to produce oil unabatedly, adding to an already-saturated market. Ironically, it seems that the significantly lower prices are forcing oil companies to produce more in order to achieve similar levels of revenue as before the crash. Should this trend continue then prices will surely have to fall further as demand for crude is still relatively weak.

However, Saudi Arabia' oil minister, Ali al-Naimi, thinks that the supply and demand forces would soon find a balance and that this will help prices to stabilise. In fact, Saudi has already increased its asking prices for oil deliveries to Asia and the US on Tuesday, in a move that suggests demand may be on the ascendency.

Technical outlook

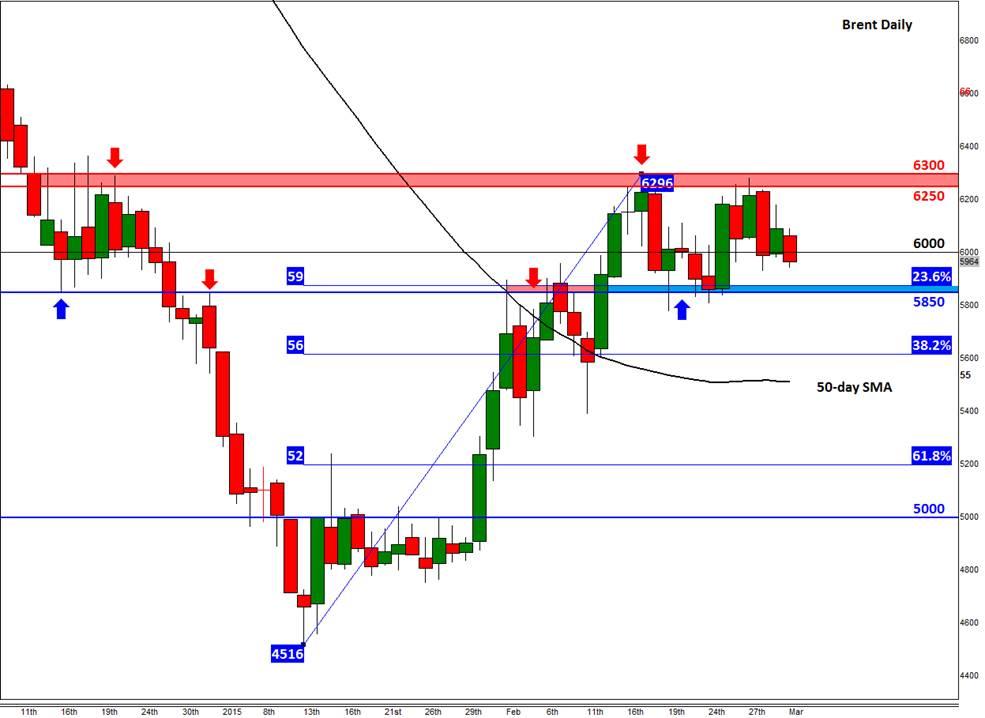

The daily chart of Brent (figure 1) shows the London-based oil contract is still in consolidation. As can be seen, Brent is still holding its own above $58.50/59.00, and area which was previously resistance and also corresponds with the 23.6% Fibonacci retracement level of the recent upswing. As this is a particularly shallow retracement level, it points to potentially large gains IF resistance around $62.50/63.00 eventually breaks. However if the bears win the battle here then we may see a sizeable pullback towards some of the support levels shown on the chart, with the first such level being the 38.2% retracement at just above $56.

Meanwhile the 4-hour chart of WTI (figure 2) also shows a somewhat similar picture. After creating a triple top reversal pattern a couple of weeks ago at $54.00, WTI has generally traded lower before finding some decent support around $48.75. As thing stand, a decisive break above $51.00/51.25 would mark a bullish technical development while a potential break below $48.75 would be a bearish outcome. In other words, we are neutral on WTI while it holds inside this $2.5 dollar range.

Figure 1:

Figure 2:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady above 1.0650, awaits US data and Fed verdict

EUR/USD is trading sideways above 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD flatlines below 1.2500 ahead of US data, Fed

GBP/USD is off the lows but stays flatlined below 1.2500 early Wednesday. The US Dollar strength caps the pair's upside amid a cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold price remains on tenterhooks with eyes on Fed policy decision

Gold price hovers below $2,300 as uncertainty ahead of the Fed’s policy announcements improves the appeal of the US Dollar and bond yields. The Fed is expected to support keeping interest rates at their current levels for a longer period.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.