![]()

The data-heavy portion of the week has officially kicked off, and today’s economic figures have confirmed some of the recent trends we’ve been highlighting. As my colleague Chris Tedder noted earlier today, Australian GDP came out a tick weaker than expected, though the Australian dollar remains resilient and is actually trading higher than it was prior to the release.

Meanwhile European data was mixed, with Service PMI figures coming in roughly in-line with expectations at 53.3 vs. 53.5 eyed (note that this is still an improvement from last month’s 52.6 reading), but Retail Sales figures coming out far better-than-anticipated at 1.1% m/m against expectations of a 0.2% rise. These figures extend the under-publicized trend of gradually improving economic data in the Eurozone, but the euro is edging lower ahead of ECB President Mario Draghi’s highly-anticipated speech tomorrow (for more on EURUSD, see my colleague Fawad Razaqzada’s report, “EUR/USD on the Verge of Another Breakdownâ€)

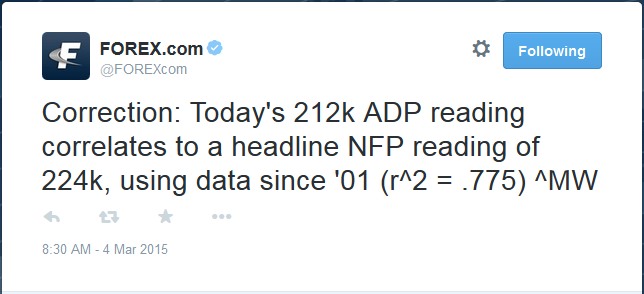

Following the sun across the Atlantic, US economic data has also been inconclusive. The ADP Non-Farm Employment report came in slightly below the anticipated 219k reading at 212k, but it was accompanied by a notable upward revision to last month’s report. Overall, the ADP report signals that another strong month of growth is likely in Friday’s NFP report, as we noted on twitter:

Now, traders will turn their attention to the ISM Services PMI report, which tends to be a strong leading indicator for Non-Farm Payrolls. Expectations are for a headline reading of 56.5 after last month’s 56.7; the employment subcomponent came in at 51.6 last month.

Technical View: USDJPY

One way or another, USDJPY traders are hoping the Friday’s NFP report will inject some volatility into the moribund pair. Rates have been trapped in a tight 200-pip range from 118.30 to 120.30 over the last month, leaving only short-term trade opportunities. While the Slow Stochastics indicator on the 4hr chart has done a decent job of identifying short-term tops and bottoms, trend traders will remain on the sidelines until we can see a break from this tight consolidation zone.

Another strong month of jobs growth, especially if accompanied by further increases in average hourly earnings, could keep the June rate hike scenario on the table. In that case, USDJPY may break above 120.30 resistance and potentially make another run toward its multi-year high at 121.85. On the other hand, a disappointing jobs figure or contraction in wages could send USDJPY back down to 118.30 support or below as the prospects for a June rate hike by the Federal Reserve fade further.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.