![]()

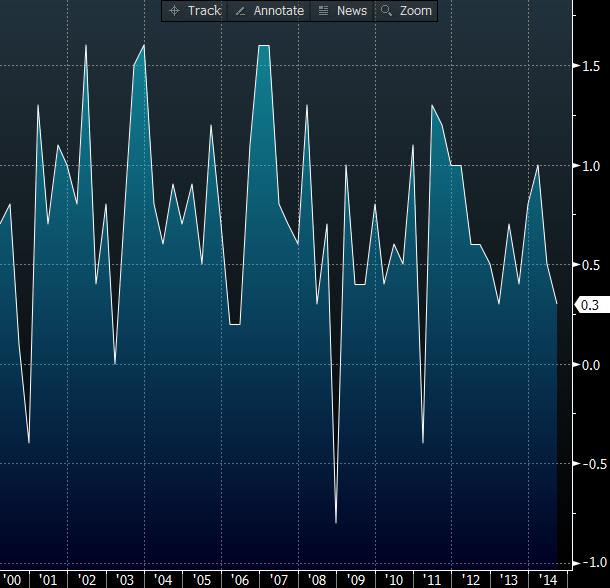

Later today we are expecting Australia’s growth figures for last quarter. The market is looking for a 0.6% q/q growth rate, which is better than the prior quarter’s very disappointing 0.3% jump – it was an important factor in our decision to lower our rates forecast for Australia. We think the risk for todays’ figures (released at 0030GMT) is tilted to the downside once again. Private non-farm inventories fell a worrying 0.8% q/q in Q4, which is a drastic change from Q3’s 1.2% increase. Without this backing, GDP figures for Q4 may underwhelm the market expectations and see AUDUSD test the base of its new trading range.

Australian q/q GDP growth

Source: FOREX.com, Bloomberg

Shortly after we are expecting to hear from Fed Chair Yellen and then glimpse HSBC’s services PMI data for February. Yellen is expected to talk about bank regulation so we aren’t expecting it to have a huge impact on USD, although it’s definitely worth keeping an eye on what the Fed chief has to say. At 0145GMT we are turn our focus to China and HSBC’s Services PMI (prior 51.8) – this index does carry the same weight as its Manufacturing brother, but further weakness in the services sector would only add the market’s concerns about China’s economy.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.