![]()

European stocks have had a blinding 2015 so far, the Eurostoxx index is up nearly 20% since early Jan, for all of the Eurozone’s problems the market is keeping faith with European equities. The reasons for the rally are well known: QE from the ECB and a falling EUR. But surely those things are priced in now? After weeks of people talking about money flowing out of the US and into Europe, has this theme had its day?

We think no for a few reasons including:

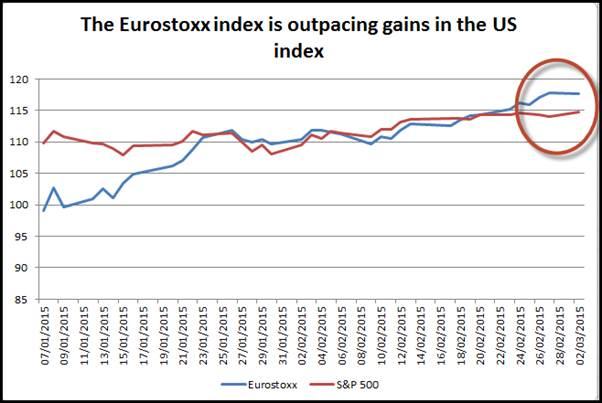

1, Momentum: figure 1 shows the Eurostoxx index and the S&P 500, the chart has been normalised to show how they move together. As you can see, the Eurostoxx index has started to pull away from the US index. Even though the US index is still making record gains, the European index is outpacing its US rival, which suggests that momentum is on the side of European stocks for now. What is interesting is that US stocks have outpaced European stocks for most of the last 5 years, so now it could be Europe’s turn to play catch up.

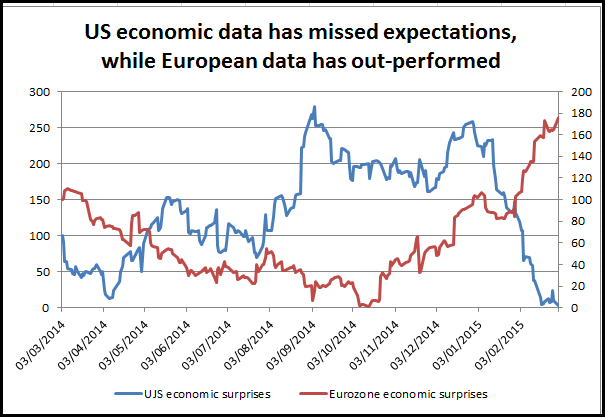

2, Fundamentals: When you trade the indices it’s always worth getting an overview of the economic fundamentals for the region. One way to find out if sentiment towards an economy is shifting is to look at an economic surprise index. Citigroup provide economic surprise indices for the major economies. As you can see in figure 2, as the US index has plunged to a 2-year low, indicating that data has missed expectations, while the European index has risen to a 1.5 year high as data has outperformed expectations. While the overall growth rate in the US may be higher, if economic data continues to miss expectations, or if the recent bad weather weighs on Q1 growth, then we could see the US index struggle as growth expectations for the US in 2015 are revised lower. At the same time, the Eurozone could be entering a brighter spot for its economy, which could keep interest in the Eurostoxx 50 index high.

2, Value: While the price-to –earnings ratio of European stocks is actually higher than its US counterpart after the January price rally, the European index is some way off its 2000 highs, in contrast to US stocks which continue to move into record territory. This could trigger investors to take profit on US stocks and continue to move into European stocks where “value” and opportunity for further upside could look more attractive, especially if US economic data continues to miss expectations.

Looking ahead:

Although we think there are some solid reasons for European markets to continue to play catch up with their US counterparts in the coming weeks, we do not think that US markets will fall off a cliff. For a start the US index has a larger tech sector which is firing on all cylinders and driving US stock market gains. We continue to think that tech stocks in the US could outperform, which could keep the Nasdaq and S&P supported from a sharp sell-off.

Conclusion:

Rather than look for one index to falter and one to continue to move higher, we think that both European and US indices could move higher together, however, European indices may continue to out-perform and we could see an extension of figure 1 over the next month.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.