![]()

The sun rises on a new trading day, and traders rolled out of bed particularly eagerly today in anticipation of the Fed’s monetary policy announcement. With a staggering number of central banks across the world turning more dovish over the past two weeks, traders are starting to wonder if the Fed can maintain its moderately hawkish posture. On one hand, economic data (particularly when it comes to the labor market) has been relatively solid of late, but on the other hand, there lack of any inflationary pressures and the economic slowdown overseas could cause the central bank to lean more toward leaving policy unchanged and reevaluating in March.

We tend to fall in the latter camp. No doubt you’ve heard the marketing spiel that “40 is the new 30,†but in the current low-and-getting-lower interest rate world, traders seem to believe that “neutral monetary policy is the new hawkish†as the US dollar continues to surged despite the Fed’s balanced outlook. This dollar strength, in and of itself, exacerbates the problem of low inflation as the price of imports drop and the profits of multinational companies are hit.

Therefore, the Fed’s statement should reiterate that the central bank can “be patient in beginning to normalize the stance of monetary policy†as the central banks punts the tough decision on whether to change its guidance to the March meeting, when it can be more fully explained by a press conference with Fed Chair Yellen (this meeting does not feature a press conference or the Fed’s Summary of Economic Projects, aka the “dot chartâ€). Therefore, today’s monetary policy statement may pass without much excitement, much to eager traders’ chagrin.

Technical View: USDJPY

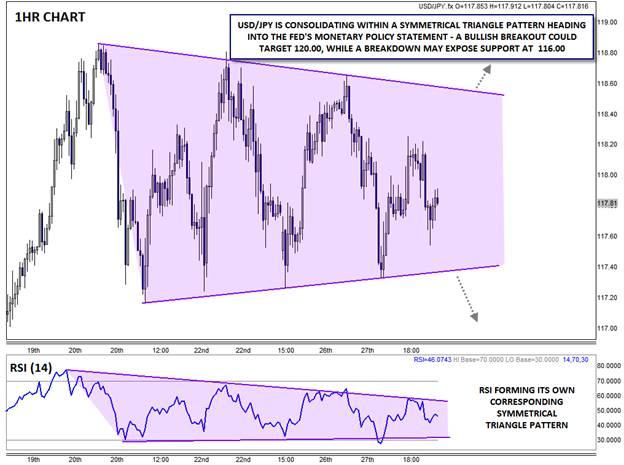

As we often note, US data and announcements tend to have the cleanest and most “logical†reaction on USDJPY, and that pair could certainly use a shot of adrenaline right now. Over the last week and a half, USDJPY has traded in a tight range, staying within about 80 pips of the 118.00 handle since mid-January.

Looking to the chart, rates have put in a series of modestly higher lows and lower highs, forming a symmetrical triangle pattern. For the uninitiated, this pattern is analogous to a person compressing a coiled spring: as the range continues to contract, energy builds up within the spring. When one of the pressure points is eventually removed, the spring will explode in that direction. Similarly, when USDJPY breaks out from its triangle, a strong continuation in the same direction is likely. Astute traders will also note that there is a corresponding symmetrical triangle pattern in the RSI indicator.

That said, it’s notoriously difficult to predict the direction of the inevitable breakout. Therefore, readers may want to wait for the breakout statement before trading. Based on the height of the triangle, USDJPY could continue in that direction for around 150 pips, which could take rates up to around 120.00 on a bullish breakout or back down toward the 2-month low near 116.00 on a bearish breakdown.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.