![]()

It’s been one of those trading days where all the excitement took place early in the session. US equities tanked this morning, with the Dow Jones Industrial Average down nearly 400 points at one point before moderating back to a still-large 300-point drop by the end of the day. Meanwhile, the US Dollar Index was holding at its 11-year high around 95.00 prior to the US open, but dollar bulls chose to book their profits rather than press the trend, and the dollar is currently trading back down near 94.00. One of the components driving the dollar index back down was the Swiss franc. Admittedly, Switzerland’s currency only has a 3.6% weighting in the dollar index, though it has been particularly volatile of late.

Looking to the 4hr chart, USDCHF settled into a 300-pip range from .8500 to .8800 in the week after the SNB’s unexpected decision to drop the cap on the Swiss franc. However, rates broke out of that range yesterday, briefly surging to a high in the mid-.9100s earlier today before pulling back. This price action created a large Doji* candle on the 4hr chart, showing indecision in the market.

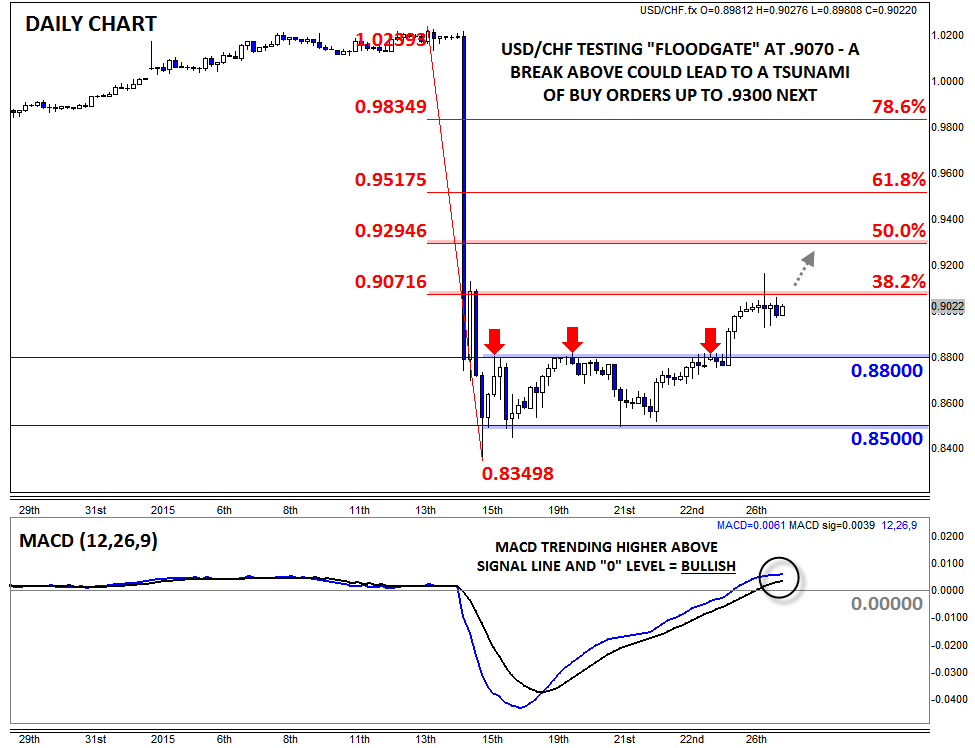

From a technical trading perspective, large moves like the one caused by the SNB two weeks ago creates crystal-clear Fibonacci retracement levels that tend to hold more significance than usual. In this case, the pair seems to have settled in the lower-.9000s, just below the 38.2% Fibonacci retracement at .9070. While this barrier may prove to be a tough nut to crack, the MACD has recovered all the way back to its pre-SNB level and is currently showing bullish momentum by trending higher above its signal line and the “0” level.

Moving forward, readers can think of the .9070 level as a “floodgate” of sorts: if bulls can push USDCHF above that level, an influx of buying pressure may drive rates all the way to the 50% Fib retracement at .9300 next. On the other hand, if that gate remains closed, the pair may remain “dammed” between previous-resistance-turned-support at .8800 and the .9070 level.

*A Doji candle is formed when rates trade higher and lower within a given timeframe, but close in the middle of the range, near the open. Dojis suggest indecision in the market.

Source: www.forex.com

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold price turns red below $2,320 amid renewed US dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is Securities and Exchange Commission (SEC) filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.