![]()

Just because the market’s mind is concerned with things of a turkey nature does not mean that themes are failing to develop. Today’s data has been illuminating and could drive equities and FX in the next few days.

1, Worrying trends in UK growth

First up came news about the UK economy. Overall Q3 GDP was unrevised at 0.7%; however the detail of the report painted a different picture. Not only is growth slowing, but it’s the wrong kind of growth. The recovery is dependent on private consumption and government spending (bad), while exports and investment (good) are slowing sharply. Exports fell 0.4% in Q3, while imports rose 1.4%, so the UK is, once more, spending more than it earns. Exports have fallen by more than 10% in the last 12 months, mostly on the back of the slowdown in the Eurozone. That may sound like an excuse, but the UK government’s plans to turn around our export sector could not have come at a worse time with both Eurozone and Chinese growth taking a stumble. Private consumption is a bright spot, and it will be interesting to see if UK retailers can benefit from post-Thanksgiving “Black Friday” sales that are being advertised this side of the Atlantic. Government spending also boosted growth, and it was revised up to 1.1%, while the market had expected a reduction to 0.2%. The fact that the government decided to ramp up spending is hardly surprising given that we were less than a year from the next UK election, however it is slightly embarrassing for a government who has staked its reputation on debt reduction. This goes some way to explain why government borrowing continues to rise. This data also helps us to understand the BOE’s note of caution in its recent Inflation Report, and supports a weaker pound in the medium-term.

2, More trouble for the ECB

German import price inflation for October may have fallen by less than expected, however, on an annualised basis inflation was still down by 1.2%. Thus, Germany is still importing deflation, which does not bode well for the Eurozone’s flash estimate of November CPI due on Friday. On an otherwise quiet day, this inflation data could keep things interesting for the EUR into the weekend, and a reading lower than 0.3% could trigger a collapse to 1.20.

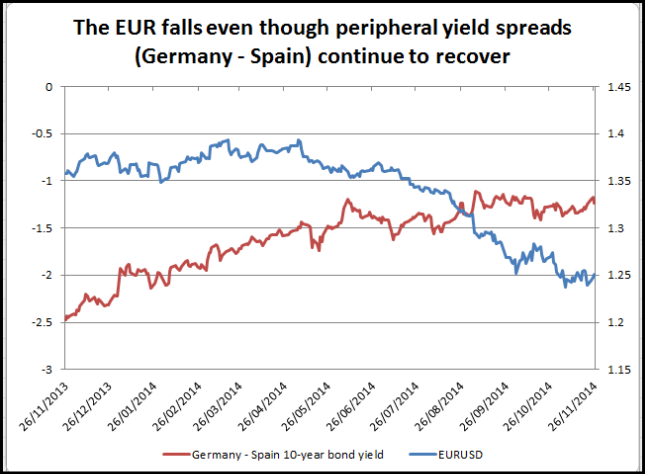

Narrowing yield spreads in Europe’s periphery have tended to equate to a stronger euro, but as you can see below, this is not the case at the end of 2014, with tightening spreads contrasting with the sour tone to the EUR. However, this trend has been bucked today – bond yields in Europe’s periphery are rising at the same time as the single currency, EURUSD is at its highest level since 21st November. We think today’s price movements are an anomaly and looking forward, we would not be surprised to see European peripheral bond yields continue to fall alongside the EUR, as the latest trends in German import prices add to pressure on the ECB to embark on some form of QE in the New Year. See figure 1 below for more.

3, Has the US joined the global economic slowdown?

The US squeezed the last of this week’s data into Wednesday, however rather than pass by unnoticed on this quiet week, the weaker tone to the US data has unnerved some in the market as they assess whether this is the start of a trend, or just a blip. Initial jobless claims jumped above 300,000 for the first time since mid-September last week. However, the 4-week moving average remains below the 300k mark. We will watch this data to see if it was just a blip or the sign of something more serious. Durable goods orders excluding defence and aircraft fell 1.3% in October. Durable goods are a proxy for business investment, which could be retracting as global growth starts to slow.

Consumer confidence may have fallen back in November, but the real test for the US consumer will be Black Friday sales. We should know if the US consumer lived up to its reputation by the weekend, if sales break records then fears about global growth could fade into the background and we could see the dollar index decisively break above 88.00, its highest level since 2010.

4, OPEC

This is the main event for an otherwise quiet Thursday. Read our preview HERE Comments worth noting today include the Saudi oil minister who said that production did not need to be cut. It appears that Iran is sticking with the Saudi’s on this one. The only hint of discord came from the UAE who blamed the US for causing a global oil supply glut. Tomorrow is the main event with the post-meeting press conference scheduled for approx. 1500 GMT. At this stage it appears very unlikely that the cartel will cut production, although it may announce a meeting in 3 months’ time to assess the situation. Oil is lower again today, and WTI has fallen some $3 since OPEC arrived in Vienna on Tuesday. Thus, the “bad” news on production could already be priced in, even though we continue to think WTI oil could fall to $70 in the coming days.

Overall, the markets are quiet, the dollar is losing some steam, equities are directionless as volume seeps out of the market, the EUR is making a short-term comeback and oil is under pressure as we wait for the outcome of the Opec meeting.

Figure 1:

Source: FOREX.com and Bloomberg

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price struggles for a firm intraday direction, hover above $2,300

Gold price fails to lure buyers amid a fresh leg up in the US bond yields, modest USD uptick. A positive risk tone also contributes to capping the upside for the safe-haven precious metal. Traders, however, might prefer to wait for the US NFP report before placing aggressive bets.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: the hawkish pivot that never was, and the massive surge in the yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.