![]()

As the new trading week begins, the markets are giving back some of the gains made at the end of last week. There are no major economic data to provide further fresh stimulus, which together with technical selling are scaring away some of the bulls. At the time of this writing, both the European markets and US stock index futures are at their lowest levels on session. Had it not been for a decent earnings season so far, the markets would have likely been much lower. All eyes are on Apple tonight and although the recently announced products such as the iPhone Plus are not factored into their results, a good set of numbers could nonetheless provide some support to tech stocks and possibly the wider market as well. But until Apple’s results are out, there’s not much to look forward to, so speculators are likely to focus more on the technical side of things than fundamentals.

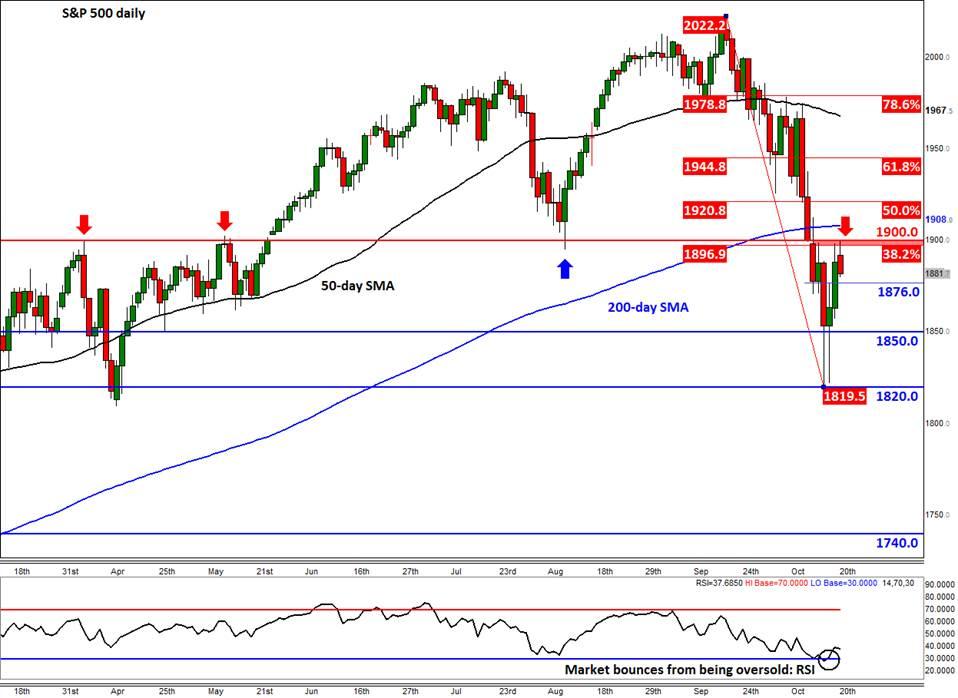

A quick look at the S&P 500 charts unfortunately suggests more losses could be on the way, because the key 1900 level, which had been support in the past, is now holding firm as resistance. Unless the bulls manage to recapture this level, the path of least resistance would remain to the downside. As such, a move down to support at 1876, 1850 or even last week’s low of 1820 could be on the cards in the coming few days. A potential break below the 1820 level would be a particularly bearish development and we could then see the onset of another major leg lower. Worryingly, the fact that the S&P has only managed to pull back to the shallow 38.2% Fibonacci level (at 1897) suggests the market is still positioned short and that the next leg lower could potentially be quite significant. Meanwhile a decisive break above 1900 could spark a rally towards the 200-day average at 1908 in the short term and 1945 – the 61.8% Fibonacci retracement level – in the slightly longer term.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.