![]()

Market sentiment is back at the end of the week, stocks in Europe are higher, oil prices are rising and even Greek bond yields are falling. Central bankers from the US and UK have saved the day, but will volatility recede from here?

Although Fed Governor Yellen did not mention Fed policy or the economic outlook during her speech on Friday, it seems she left the talking to other members of the Fed, Thursday’s comments from Bullard, a member of the Federal Reserve and a noted dove, said that inflation was a “little off target” and the Fed should consider delaying the end of QE at this month’s meeting. While Bullard is a non-voter on this year’s Federal Reserve Board, and he won’t actually have a say in monetary policy changes until 2016, we still think that his thoughts reflect a majority of views at the Fed.

Staying the Fed’s hand

We mentioned recently, that there was a subtle shift in the rhetoric coming from the Federal Reserve recently, from employment growth to weak inflation. Prices are king for the Fed these days, and if prices continue to fall then we could see the Fed delaying the end of QE3, or even extending the programme through to the end of the year. The Fed’s Rosengren, another noted dove, told CNBC this afternoon that he does not want to see the inflation rate going down. However, unless we see a prolonged recovery in the oil price, global disinflation pressure could continue to weigh on US prices, which could stay the Fed’s hand.

BOE follows Fed’s lead

The prospect of central bank support, in particular Fed support, has boosted the markets. However, other central bankers have joined in the Fed’s chorus. The Bank of England’s chief economist has joined in the fray, and said that interest rates could stay lower for longer in a “gloomier economy”. He also mentioned the low inflation pressure in the UK as a cause for concern for the BOE, and said that the BOE could be on the “back foot” (a cricket analogy), when it comes to raising interest rates, due to the weakening economic data.

The Bundesbank bucks the dovish trend

The ECB is the one exception to the rule. Even though some of this week’s volatility was caused by rising sovereign fears (Greek bond yields surged to nearly 9% on Thursday, they have since fallen on Friday), the ECB is not singing from the same dovish hymn sheet. The head of Germany’s Bundesbank, Jens Weidmann, has said that deflation risks to the Eurozone are low, and he also voiced his concern about ABS asset purchases (the ECB’s version of QE-lite), saying that it is a move towards a “QE philosophy”, and he didn’t mean it as a complement. Weidmann is also not in favour of giving Germany any more stimuli, saying that it could backfire, even though the currency bloc’s largest economy is showing signs that growth contracted last quarter. His comments were reflected by ECB member Nowotny, who also dismissed inflation fears, saying that low inflation due to oil is actually positive.

The comments from Weidmann and Nowotny are in contrast to other ECB members, including Coeure, who said that the ECB is committed to taking additional measures if necessary. A split at the ECB, with the powerful Northern bloc sounding hawkish, and other members sounding dovish, could cause trouble if we see further sovereign fears.

One to watch: EURUSD

While the Fed is in focus this is helping markets to stage a recovery. However, if Eurozone sovereign fears rise once more, loggerheads at the ECB could hurt market sentiment, and European assets in particular, which is why we expect EUR to trade back towards 1.25 in the coming days. Although EURUSD has bounced in the last 5 days, the retracement of the May – October down-move has been shallow so far, suggesting that the bears are in control and this recent pullback will be temporary only.

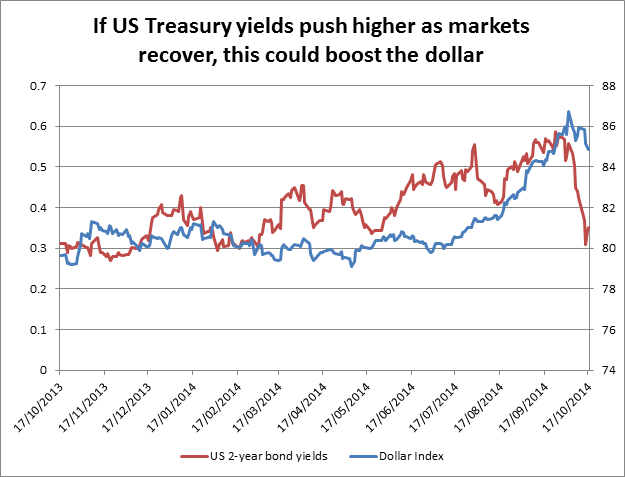

A dovish Fed could be dollar positive…

This may sound odd, but if Fed members stick to their dovish mantras then it could benefit the US dollar. If volatility continues to recede US Treasury yields may move higher, as the markets breathe a sigh of relief, which may also be dollar positive. If this plays out, then it could boost our view that the EUR could come under pressure in the coming days.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.