![]()

The powerful uptrend in the dollar had been the key theme for the FX market in Q3, however, its performance at the start of Q4 has been fragile compared to what we have come to expect, and it may start to unsettle markets.

During Q3 the dollar was able to rally even though geopolitical risks were heating up as Russia/ Ukraine tension escalated. The dollar thrived as the Fed pondered its next move after the end of QE3, which is due to come to an end later this month. Perceived Fed “hawkishness” combined with relatively low volatility proved to be optimal conditions for the greenback to make multi-year highs.

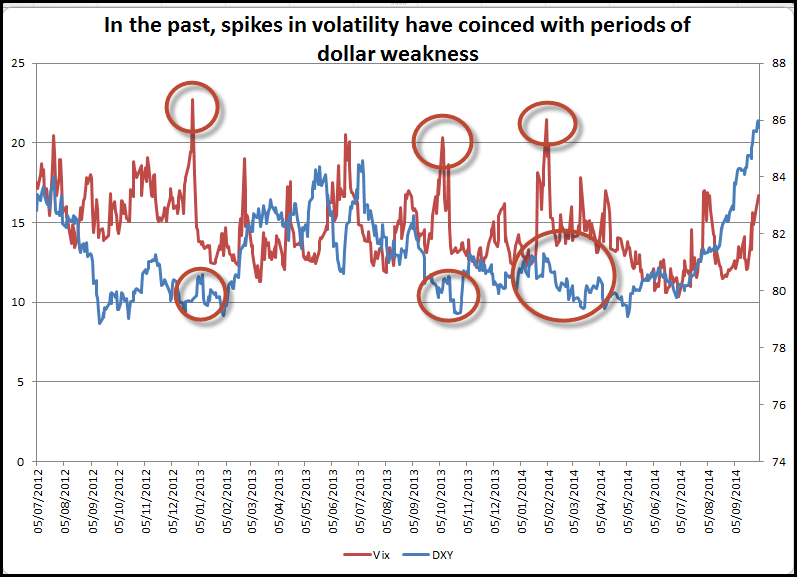

However, as the Vix index gets closer to the August spike above 17, the dollar is starting to get jittery, as you can see in the chart below. One reason why the dollar is lower today is due to the resurgence in the yen. USDJPY hit the psychologically important 110.00 level on Wednesday and after twice trying to break through this level it gave up the fight and fell to a low of 108.32.

Geopolitics could also start to have an impact. Earlier this week the markets seemed to brush off the protests in Hong Kong. However, as China hardens its stance towards the protestors, markets are starting to react. While earlier this week the selloff was mostly centred in the Hang Seng, today most Asian markets are lower. The Nikkei fell more than 2.5%, which dragged USDJPY with it. The trade-weighted yen, which made a 6-year low on 18th September, has started to pick up. So far, the rise has only been moderate; however, further yen gains could be dependent on the on events in Hong Kong. If the protests escalate, and we get an response from China, and potentially the West, then the yen could roar back into life as a safe haven.

If this happens then it could seriously dent USDJPY’s chance of extending gains above 110, it could also accelerate the recent decline in global equities as markets may shudder at the thought of geopolitical risks that concern China.

This does not mean that the dollar will crumple; we still think it could have further to go against some EM currencies and also versus the EUR. GBPUSD has fallen to a three week low today after Bank of England newbie Kristen Forbes said that the data does not yet show “sufficient” inflation pressure to warrant a rate rise.

While there could be more life in the dollar up-trend, we are watching out for three main risks:

1, Can the dollar rally if we get another sub-150K payrolls report on Friday?

2, Protests in Hong Kong could disrupt the rally in USDJPY.

3, Inflation.

The last point is worth keeping an eye on. The BOE’S Forbes mentioned that inflation is not “sufficient” to warrant a rate hike, we have also noticed a subtle shift in rhetoric at the Federal Reserve, with uber dove William Dudley saying that he would rather see prices above 2%, and the economy “running hot” for a while before he votes to hike rates. If Dudley and co. at the Fed need to see an increase in inflation before they raise rates, they may have to wait some time. There seems to be a global disinflationary impulse, manifested mostly in the Eurozone, that may start to spread across the Atlantic as energy prices are falling, and WTI is below $90, which could keep prices low for some time.

Although we don’t want to stand in front of a powerful dollar uptrend, we would urge some caution as a few risks start to build for the greenback. Watch US CPI reports as well as events in Hong Kong. For now dollar weakness is mostly centred in USDJPY, but October could prove to be a tricky month for the greenback.

Conclusion:

As you can see in the chart below, recent spikes in volatility (since 2012) have coincided with dollar weakness. However, back in 2010, at the height of the Eurozone sovereign crisis, volatility spiked, but the dollar moved higher as EURUSD fell sharply. Thus, if ECB’s Mario Draghi manages to talk down the EUR later today then the dollar could be protected if we see another spike in the Vix. However, as risks rise globally, the dollar’s push higher may not be as easy as it was in September.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.