![]()

This Thursday we get the monthly ECB meeting. After surprising us with those rate cuts and a program of asset-backed security (ABS) purchases (basically QE-lite) last month, we doubt the ECB will pull the trigger on more policy actions at this meeting. Without any new policy actions to hide behind, the ECB could find itself with some tricky questions to answer.

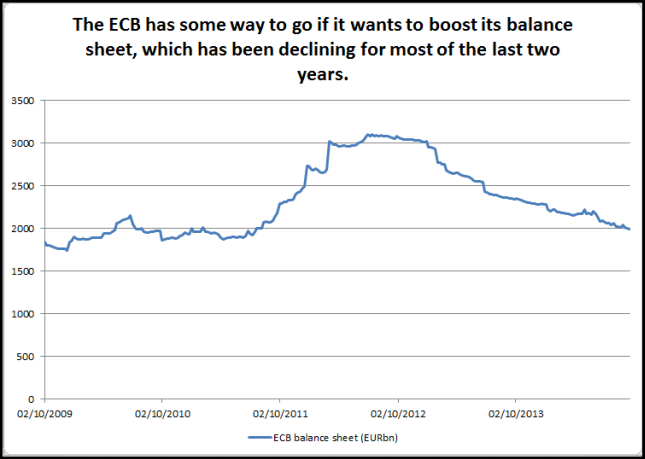

The first question could be around how the ECB plans to expand its balance sheet. This is said to be the ultimate goal of its latest bout of policy action, but it looks like it could be an uphill battle (see chart below). The first auction of Targeted Long-Term Refinancing Operation (TLTRO) loans was a bit of a disaster, with European banks only taking EUR 90 billion of the near trillion EUR available. This was not enough to cover the EUR 105 billion of previous LTRO loans that expired last week, so for now the ECB’s balance sheet continues to shrink. We expect Draghi to defend his TLTRO program by saying that it was only the first of seven TLTRO auctions; he may also say that the next auction, scheduled for December, could attract more bids for loans as it will come after the ECB’s own bank stress tests, when Europe’s banks may be more inclined to borrow money.

The next thing we expect Draghi to tackle during his press conference is the ABS purchase program announced last month. Last month Draghi said that the Bank would start its ABS program in October, and he would announce more details at this press conference. The market will be focused on its size. Something deemed too paltry could spark another leg lower in the EUR, as it could make a more radical measure such as QE more likely. Press reports have suggested that ABS purchases could top EUR 500 billion, and anything less than that could be deemed a disappointment at this point.

We remain skeptical about the ECB’s ability to increase the size of its balance sheet, and we doubt that the ECB’s balance sheet will top the size of the Fed’s balance sheet any time soon, even though the US is in recovery mode and the Eurozone’s economy is still in deep trouble. The Fed was able to super-size its balance sheet by buying sovereign debt (US Treasury securities); however, this is politically problematic in the Eurozone, with countries like Germany against buying domestic debt. Thus, we don’t think that the ECB will ultimately pull the trigger on QE, but the market is unlikely to take the same view. If Draghi sounds disappointed in the TLTRO program and the ABS purchase program details seem measly, then we could see a sharp decline in the EUR on the back of the market getting QE-happy.

At this meeting we expect Draghi to launch his last weapon of mass destruction: talking the currency lower. In our view a weaker EUR is the only option left for the ECB for the rest of this year, and we expect lashings of negative EUR rhetoric at this week’s press conference.

From an FX perspective, in the absence of more powerful accommodative steps from the ECB, a weaker EUR plays into the ECB’s hands as it could be the most powerful driver of growth open to Draghi and co. Thus, we could see Draghi try and talk down the EUR at this week’s meeting. We have mentioned the fact that the fundamental and technical views are looking quite weak for the EUR right now, and if current downside momentum in EURUSD is maintained then we could see back to 1.20, the lowest level since before Draghi said he would do “whatever it takes” to save the currency bloc, back in July 2012.

From a technical perspective, after the close below key support at 1.2661 – the November 2012 low, is a major bearish development that opens the door to further losses. Since the trending and momentum indicators are all pointing lower, if we stay below November 2012 low then we could see back to 1.2043 – the July 2012 low.

We have also been keeping an eye on EURUSD’s daily RSI, which is in oversold territory. When this happens it can signal a reversal; however, in this instance we believe that the fundamental factors could continue to weigh on the EUR, and any strength in EURUSD could be short-lived. Short-term resistance lies at 1.2661 initially, then at 1.2761, the high from 26th September.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.