![]()

Over a century ago, Charles Dow codified one of the first technical analysis frameworks, which eventually came to be known as Dow Theory. One of the basic tenets of the theory is that the market immediately discounts all new information as soon as it is released, a premise that Dow’s theory shares with the influential Efficient Market Hypothesis (EMH). In other words, the market is forward looking. Without getting into a philosophical debate about the merits of EMH or Dow Theory, it is clear that markets adjust to new information very quickly, bringing us to the GBPUSD.

Last week, traders were getting tied in knots about the upcoming Scottish Independence vote, but a brief glance at the rally in the GBPUSD would have revealed that the feared “yes†vote to independence was unlikely to emerge. Indeed, the pair rallied over 400 pips trough-to-peak in the two weeks leading into the referendum, clearly showing that traders were discounting the increasingly likely probability of a “no†vote.

However, once the “no†vote was confirmed on Friday, the GBPUSD actually fell as forward-looking traders had already fully discounted this outcome. Instead, investors turned their attention ahead to the uncertainty surrounding the UK’s new Devo Max reforms and the prospect of aggressively rising interest rates in the US. Traders who were reacting to the Scottish Independence vote were caught off guard, while traders who were proactively looking ahead were able to anticipate this move.

Moving forward, the developing divergence between strong economic data in the US (as evidenced by yesterday’s strong New Home Sales report) and deteriorating reports from the UK (including weak mortgage approvals, public sector net borrowing, and CBI sales data earlier this week) has some traders pondering whether the Fed may actually raise interest rates before the BOE. If the recent trend continues, expect to hear more of this possibility, accompanied by a commensurate a drop in GBPUSD.

Technical View: GBPUSD

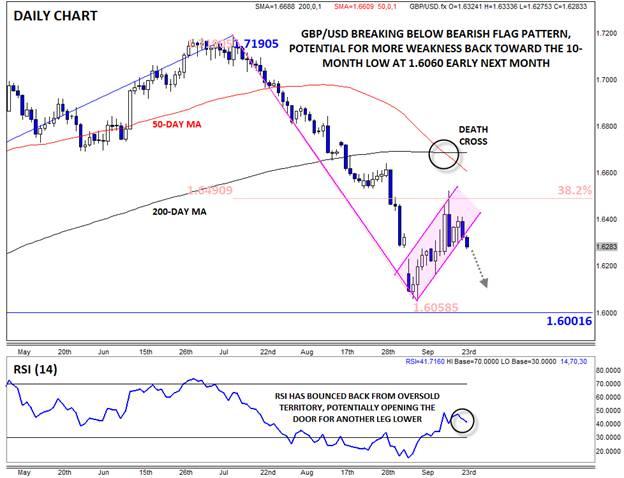

As we go to press, GBPUSD is peeking below a bearish flag pattern that formed around the Scottish Independence referendum. For the uninitiated, this pattern simply shows a shallow countertrend move (< 38.2%) within the context of a strong downtrend. If confirmed by a close below the flag pattern, it suggests a resumption of the bearish trend and a possible move back down to the recent lows. The secondary indicators support this perspective: the “flag†move took the RSI indicator out of oversold territory, clearing the way for another potential move lower, while the recent “death cross†of the 50- and 200-day moving average suggests that the longer-term trend has shifted to the downside.

As long as the pair remains below 1.6400, more weakness is favored. To the downside, support may emerge at the 1.62 or 1.6100 round handles, but continued strong US data could take rates down to revisit the 10-month lows at 1.6060 or the 1.6000 round handle early next month. At this point, bulls would need to see a close above the 38.2% Fibonacci retracement at 1.6490 before the chart would look remotely constructive.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.