![]()

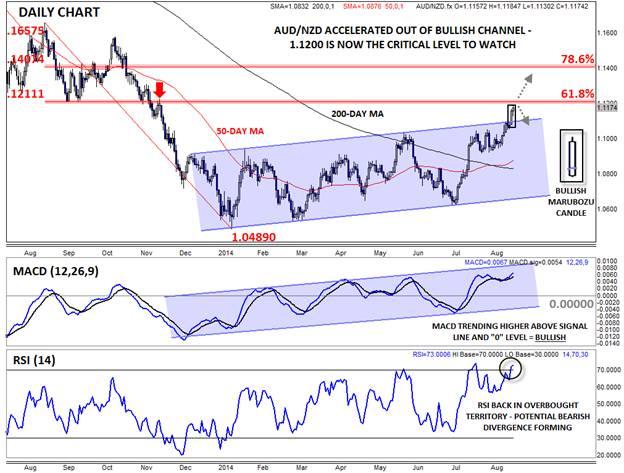

As the below chart shows, the AUDNZD accelerated out of 2014’s bullish channel yesterday, forming a large Bullish Marubozu Candle* in the process. This candlestick pattern shows strong buying pressure throughout the day and foreshadows more strength in the coming days. Sure enough, the pair is trading higher today, but with rates approaching the 61.8% Fibonacci retracement of the Aug. ’13 – Jan. ’14 at 1.1210, bulls may struggle to build on the early week momentum.

Looking to the secondary indicators paints a mixed picture. The 50-day MA recently crossed above the 200-day MA, giving a classic bullish “golden cross” signal. At the same time, the MACD is trending higher well above its signal line and the “0” level, showing strongly bullish momentum, but the RSI has snuck back into overbought territory and is showing a potential bearish divergence at the recent highs, suggesting rates may pull back in the short term.

With the bullish and bearish evidence fairly balanced at this point, the next move will hinge on whether buyers can push the pair above key resistance around 1.1200. If bulls are able to overcome this barrier, AUDNZD could easily run toward the next level of Fib resistance at 1.1400. Meanwhile, a failure to break above 1.1200 this week would favor a dip back toward the topside of the broken channel at 1.1100, if not the 50-day MA all the way down near 1.0900.

* A Marubozu candle is formed when prices open very near to one extreme of the candle and close very near the other extreme. Marubozu candles represent strong momentum in a given direction.

Source: FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.