![]()

For over two weeks now, EURUSD has frustrated both bears and bulls. After shedding 300 pips in July, the pair has now been contained to just a 110-pip range for over half of August. The recent price action has been particularly exasperating, but a developing technical pattern suggests that we may see a breakout and the return of volatility this week.

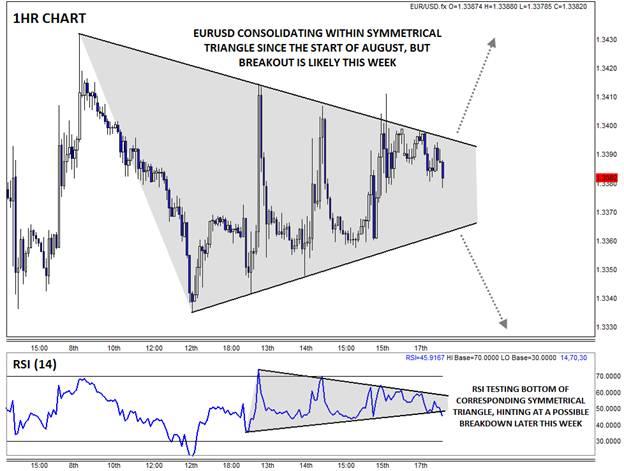

Since the minor high formed on August 1st, EURUSD has been putting in consistently lower highs, but the rates have also been forming higher and higher lows as well, creating a textbook symmetrical triangle pattern on the 1hr chart. This pattern is analogous to a person compressing a coiled spring: as the range continues to contract, energy builds up within the spring. When one of the pressure points is eventually removed, the spring will explode in that direction.

Unfortunately, it’s notoriously difficult to predict the direction of a symmetrical triangle breakout in advance, but there are tools that can help tilt the odds in a trader’s favor. For one, these patterns tend to break in the same direction as the previous trend, which in this case was to the downside. At the same time, the RSI is forming a corresponding symmetrical triangle pattern; a breakout from an indicator pattern can often lead a breakout in the price pattern itself. As it currently stands, the RSI is testing the bottom of its channel, potentially bolstering the case for a downside breakout later this week.

For now, more conservative traders may want to wait for a confirmed breakout before committing in either direction. If we do see a breakdown, EURUSD bears may look to target the 1-year low at 1.3300 next, followed by the 38.2% Fibonacci retracement of the 2012-14 rally near 1.3250. Meanwhile, a bullish breakout would point to a more substantial bounce toward 1.3450 or psychological resistance at 1.3500 next.

Key Economic Data that May Impact EURUSD This Week (all times GMT):

Ø Monday: US NAHB Housing Market Index (14:00 GMT)

Ø Tuesday: US Building Permits, Housing Starts and CPI (12:30 GMT)

Ø Wednesday: FOMC Meeting Minutes (18:00)

Ø Thursday: Eurozone Flash PMIs (8:00), US Initial Unemployment Claims (12:30 GMT), US Existing Home Sales and Philly Fed Manufacturing Index (14:00)

Ø Friday: Fed Chair Yellen Speech (14:00), ECB President Draghi Speech (18:30)

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD holds positive ground above 0.6500 on weaker US Dollar

The AUD/USD pair extends recovery around 0.6525 during the early Asian session on Thursday. The Federal Reserve held its interest rates steady at 5.25–5.50% at its meeting on Wednesday, citing a “lack of further progress” in getting inflation back down to its 2% target.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.