![]()

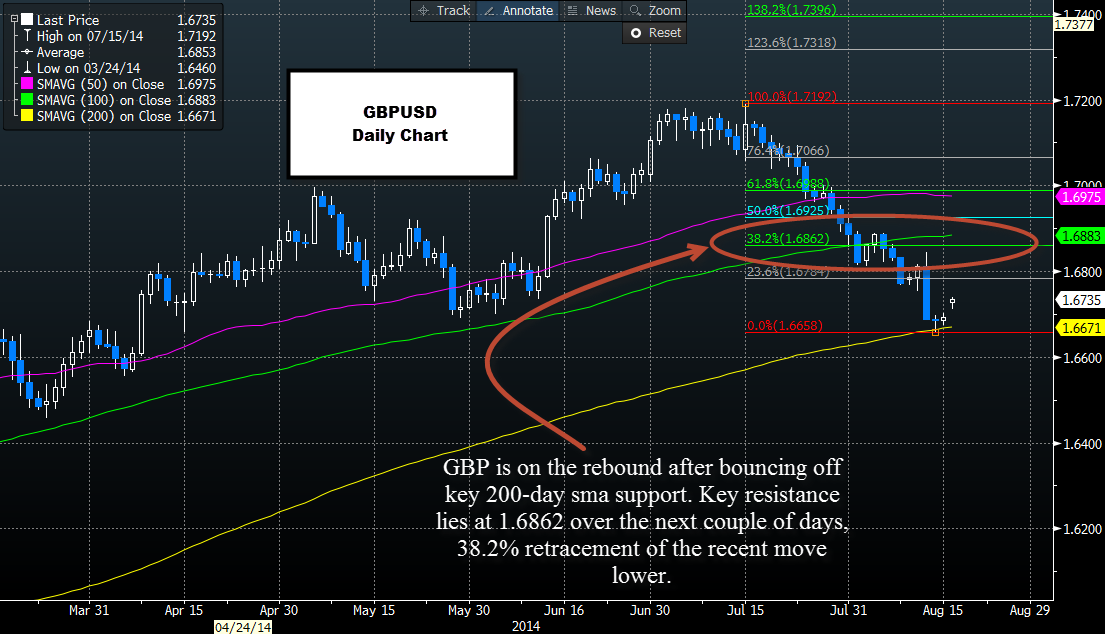

After a dismal performance last week, the pound was one of the weakest performers in the global FX space and only managed to beat the Turkish lira and Israeli shekel, the pound is back. It has bounced off its 200-day sma support at 1.6667, which has fuelled some speculation that a recovery could be on the cards.

A long wait for BOE minutes

Whether or not we extend gains this week could depend on the Bank of England minutes. Last week’s Inflation Report was considered dovish on the back of Mark Carney’s assertion that the bank may not be comfortable with raising rates until wage growth picks up, after it fell into negative territory in June for the first time since the financial crisis. However, we were thrown a curve ball by Carney at the weekend when he hinted that rates could rise before real wages (adjusted for inflation) move into positive territory.

The key takeaway from Carney’s interview with the Sunday Times include:

BOE has confidence that wages will go up, even though they are stuck in negative territory for now.

Rate increases, when they come, will be slow and steady.

He dismissed critics of the lack of dissent at MPC, no member has voted out of line with the Governor since he started in the job last year, which is the longest period since the MPC was formed in 1997.

A couple of things jump out, firstly, he is fine-tuning his message, last week he sounded downbeat about wage growth. In this interview, he is telling the market that the BOE won’t get behind the curve even if wages remain weak.

Mutiny at the BOE?

However, the market is jumping on the last point – the prospect of dissent and a split vote at the MPC. Carney acknowledged that the MPC members could vote against him in the interview. After the dovish Inflation Report the market had priced in the BOE remaining on hold until April 2015, however, the Sunday Times interview has reminded the market not to get too far ahead of itself in case other members of the BOE are not quite as dovish as Carney.

This Wednesday’s minutes are crucial for the pound. The market is pricing in the possibility of dissent as we start the week, however this leaves us open to disappointment if all members vote together.

The technical picture:

Since the pound’s fate is out of our control as it is linked to the minutes, GBP traders need to be reactionary this week, and concentrate on some key technical levels.

On the upside:

The recovery has been fairly limited so far, 1.6862 is key resistance, as it is the 38.2% retracement of the 15th July high to last week’s low. Any move back to this level ahead of the minutes could be faded by the market. If one or more members of the MPC did vote for a rate hike then we could see a protracted recovery back towards 1.6988 – the 61.8% retracement of the recent decline.

On the downside:

However, a disappointment could be bad news for GBP, as it may open the door to further losses. 1.6658 – Thursday’s low – is short term support, below here could open the door to 1.6585 – the late February low.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.