![]()

Traders often discuss how ‘month end’ flows may impact a currency or a currency pair during the last few day(s) of the month. These flows are caused by global portfolio managers rebalancing their existing currency hedges. If the value of one country’s equity and bond markets increases, these money managers typically look to sell or hedge their elevated risk in that country’s currency and rebalance their exposure back to an underperforming country’s currency. The more severe the change in a country’s asset valuations, the more likely portfolio managers are either under- or over-exposed to certain currencies.

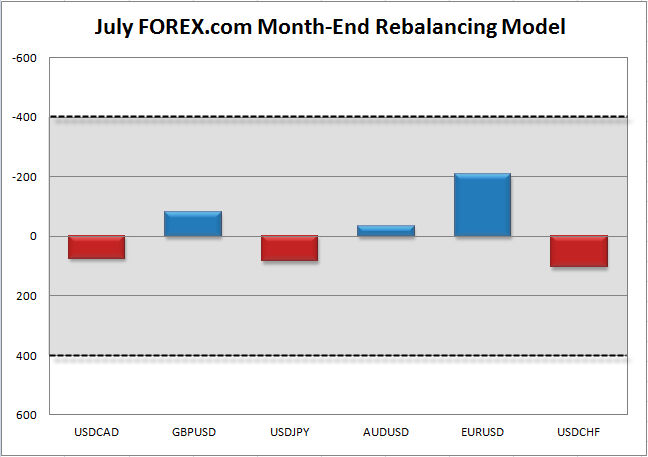

In order to predict these flows and how they impact FX traders, we’ve developed a model that compares monthly changes in total asset market capitalization in various countries. In our model, a relative shift of $400B between countries over the course of a month is seen as the threshold for a meaningful move, whereas monthly changes of less than $400B can be easily overwhelmed by other fundamental or technical factors. As a final note, the largest impact from month-end flows is typically seen heading into the 11am ET fix (often in the hour from 10 & 11am ET) as hedge and/or mutual fund portfolio managers scramble to hedge their overall portfolio ahead of the European market close.

In typical “dog days of summer” trade, global asset markets were fairly quiet in July. The largest gain in the value of stock and bond markets came from the US, where total capitalization rose by $93B (data as of July 24), whereas Europe was the biggest faller at -$113B.

While these figures may sound substantial to you or me, they are not likely to have a major impact on the global currency market, which trades in excess of $5T per day notional value. As it currently stands, none of the six currency pairs we follow meets the +/- $400B threshold to create a strong trading signal heading into the end of the month.

However, there are a number of high-impact economic reports and events that could impact global markets in the next 48 hours:

Today: US CB Consumer Confidence (14:00 GMT)

Wednesday: German Preliminary CPI (tbd), US ADP Employment Report (12:15), US Advance GDP (12:30), FOMC Monetary Policy Decision and Statement (18:00)

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.