![]()

Back to the unreliable boyfriend theory:

Mark Carney is not to be trusted. If you place your heart (or your trade) with a capricious central banker then you should expect it to get broken. In fairness, Carney isn’t the only heart-breaker in town; Janet Yellen is also starting to change her message with alarming regularity leaving the market trailing in her wake. This is the new normal, so we had better get used to it.

Forward Guidance 2.0

While the BOE’s first foray into forward guidance a little under a year ago ended disastrously and nearly cost Carney his credibility, recent bank communications suggest that the BOE has shifted to a more subtle form of forward guidance. Carney doesn’t want the market to rest on its laurels, but equally, it doesn’t want the market to get too ahead of itself, as it invariably will try to do. Thus, over the next few months, as the bank gears up to its first rate hike, central banks will be working hard to calibrate their messages, which could include regular bouts of contradictory statements. If the market gets too focused on rate hikes then the BOE (alongside other central banks that are preparing to hike rates) will reign them back in. The rest of the year could be volatile.

The meat in the minutes:

Overall, the tone of the minutes was more cautious then some had expected.

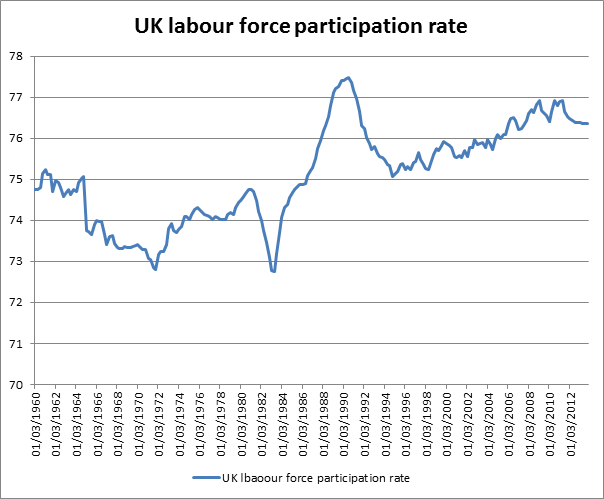

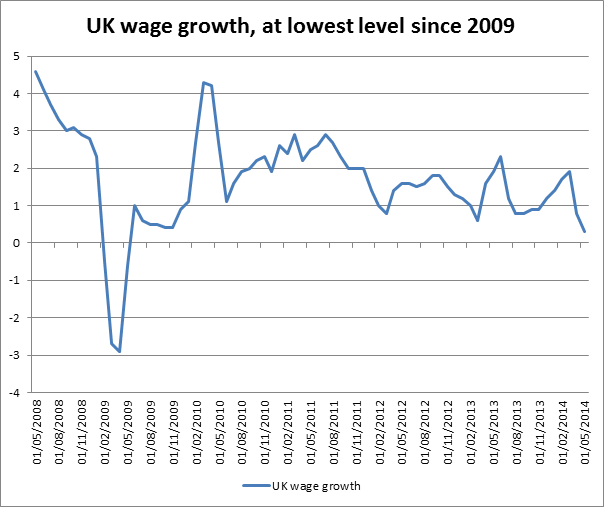

Weakness in wage growth was a key concern. The Bank debated why wage growth was so weak in the face of strong employment growth; one explanation for this was an increase in the effective supply of labour that was willing to work for less money. The Bank is concerned that if this persists “it could bolster the pool of effective labour supply and restrain wage growth for longer than the Committee had assumed.”

The Committee will consider the signal to take from the various indicators of the labour market in the August Inflation Report. Expect them to remain neutral until then.

The Bank also considered various scenarios including if rates were hiked too early, which might leave the economy “vulnerable to shocks”. An alternative scenario was one rate hike in response to stronger economic data, which would facilitate a “more gradual path thereafter”.

The minutes started by noting the rise in UK rate expectations and the pound in the prior month, which suggests it could be a cause of concern for some on the MPC.

The Bank also sounded more cautious on the outlook for growth, with household spending slowing and the prospect of weaker growth in H2 2014.

The market reaction:

The initial reaction was a drop in UK bond yields, with 2-year Gilt yields (particularly sensitive to expectations for rate changes) falling to its lowest level since mid-June. This weighed on the pound, which is testing the key 1.7040 level, a prior level of resistance and key support zone. A break below here opens the way to 1.6960 – the 50-day sma.

In the short term the minutes are bearish for the outlook for the pound, and reinforce the recent high at 1.7192 as a medium-term top. Although we remain in a technical uptrend, after a year of gains the pound may be starting to look rich, especially if the BOE does not deliver rate hikes this year. Thus, we would expect a deeper pullback in the near term. If we break below 1.6950-60 – the 50-day sma and also uptrend support - then we could see a deeper sell off back to the late May/ early June lows of 1.6693.

Figure 1: The UK’s labour force participation rate has continued to trend higher.

Figure 2: Is this why wages have remained stubbornly low? Some at the Bank of England think so.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.