![]()

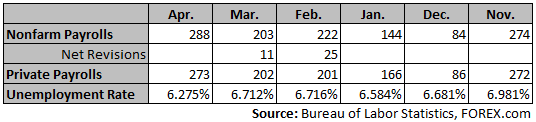

Today’s US April employment report was undoubtedly the strongest report of 2014, surprising the market with a headline print of +288K versus expectations of +218K. While the headline print was impressive, the upward revisions to the March and February readings by +11K and +25K respectively was also a positive sign – When applied to today’s April number, it brings the net amount of jobs added to 324K jobs and raised the 6-month moving average to just over 200K jobs (202.5 to be precise). More notably, this solidifies the view that ‘weather’ related distortions are now behind us, and we can look forward to a bright 2Q.

Highlights of the report:

Another shocker was the unemployment rate which decline to 6.275% (6.3% rounded vs. expectations to decline to 6.6%) – However, this was mainly attributed to a massive decline in the civilian labor force by 806K, which dropped the Participation rate by 0.4% to 62.8%…matching the level witnessed in December and October, which was the lowest reading since 1978. That said, US aggregate weekly hours for all employees continued on its upward trajectory as it rose to 100.4, which matched the March 2008 high, and continues to suggest a further potential a pickup in economic activity in 2014 – For more on why US aggregate weekly hours are so important click here. More importantly, this report affirms the Fed’s pace of tapering by $10B per meeting and suggests QE will fully come to an end in the fall of 2014.

Market response since the announcement:

USD rallied across the board – Roughly 40-60 pips

Treasuries sold off – 10 year yield is 3.5bps higher

US equities, gold and silver has nearly come back to pre-NFP levels

With the end of the week upon us don’t be surprised if pairs settle in near present levels, however with the bullish momentum built up in the dollar, namely in USDJPY, we would not be surprised if this carries over into the beginning of next week.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase of sale of any currency. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Recommended Content

Editors’ Picks

AUD/USD maintains its constructive bias above 0.6600

Further weakness in the US Dollar prompted AUD/USD and the rest of the risk-associated space to regain some balance and surpass once again the key barrier at 0.6600 the figure.

EUR/USD finds thin gains on Monday, but technicals weigh heavy ahead of US inflation updates

EUR/USD found slim upside on Monday, climbing from early bids near 1.0770 but bullish momentum remains limited with the pair struggling to break above the 1.0800 level.

Gold loses its bright amid mixed market mood

Gold prices retreated sharply on Monday from near $2,350 even though US Treasury yields declined, undermining appetite for the Greenback. Traders brace for a busy economic docket in the United States. The XAU/USD trades around $2,336, down 1% amid a risk-on impulse.

Top meme coins post gains following increased social activity amid GameStop pump

Meme coins in the crypto market saw impressive gains on Monday following a recent surge in GameStop stock. The increased attention surrounding these tokens signifies a potential resumption of the meme coin frenzy of March.

Dow Jones Industrial Average stumbles on Monday after consumer inflation outlook rises

DJIA kicked off the new trading week softly higher before getting knocked back after the Federal Reserve Bank of New York revealed that consumer inflation expectations for the coming year accelerated to 3.3%.