![]()

This is the burning question after USDJPY has declined more than 2% since the fairly solid non-farm payrolls report on Friday. So what has been driving this pair lower and is the weakness here to stay?

Although the payrolls report was solid, the market seems to have dismissed it. Instead USDJPY may be reacting to a touch of risk-off sentiment in the markets, which is driving Treasury yields lower and the yen higher. Current events weighing on USDJPY include:

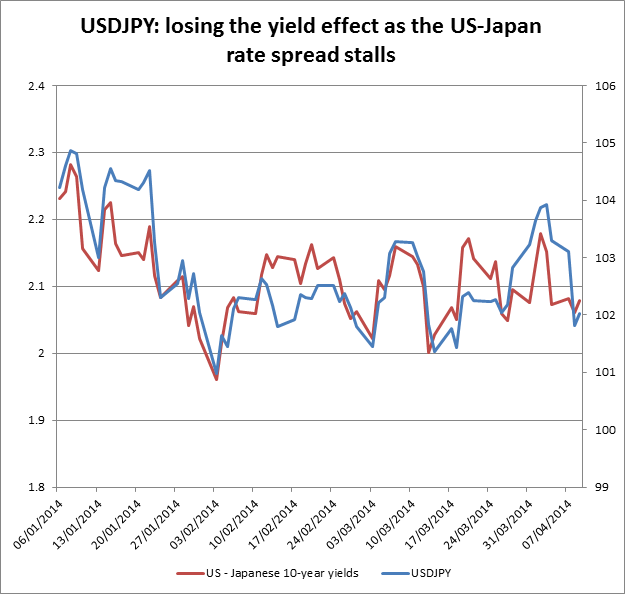

Since Friday’s NFP report Treasury yields have fallen from 2.8% prior to the release to a low of 2.67% late on Tuesday. USDJPY tends to follow treasury yields closely, so the recent decline in yields has weighed on this pair.

The BOJ failed to hint that more stimulus might be on the way in the coming months at its meeting this week. The market is expecting more BOJ stimulus to counter-act this month’s increase in the sales tax, thus this disappointment may have driven some flows into the yen.

The sharp sell-off in stocks earlier this week and the pick-up in volatility could have driven some safe haven flows into the yen also.

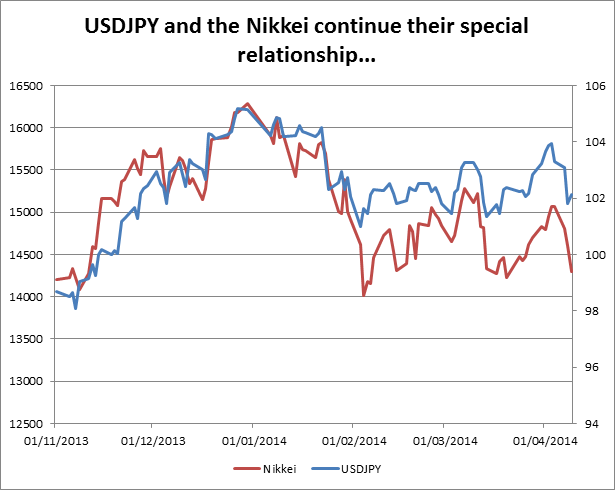

USDJPY also tends to have a positive relationship with the Nikkei, which fell 2% during Wednesday’s Asia session. USDJPY weakness followed, as you can see in the chart below.

From a technical perspective, in the short-term the dollar may experience a period of consolidation although it still looks weak. The deep sell off on Tuesday, which saw this pair lose 140 pips at one stage, triggered some short term negative events including:

A bearish crossover on the MACD.

A drop below the March 27th low at 101.72.

USDJPY has been clawing back some recent losses as we lead up to the Fed minutes released later today (1900 BST/ 1400 ET), however, it still looks vulnerable. A failure to get back above 102.37 in the short term, the 50-day sma, could trigger further declines back to 101.20 – the March low – and then 100.80 – the 200-day sma.

Takeaway:

USDJPY is following the lead from US Treasuries and Japanese stock markets and has been under downward pressure since the Friday payrolls release.

A technically weak dollar, combined with a neutral BOJ boosting the yen is proving toxic for USDJPY bulls as is the slightly risk off tone to the markets.

This pair is consolidating for now, although it still looks vulnerable to further downside.

It may take a hawkish slant to the FOMC minutes, released later today, to get this pair moving north once more. Key resistance lies at 102.84 – the mid-point of the latest sell off.

Until then, a weak Nikkei and weak Treasury yields could thwart USDJPY upside (see the charts below).

If the minutes don’t act as a salve for the bulls, then we could see further downside with the 200-day sma at 100.80 a key downside support level.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.