Greece is not the place to be right now.

Its citizens are capped out at $67 a day on the ATM. Its pensioners are pinching pennies. Its doctors are leaving in droves. Its long-term demographics are deplorable, making the chances for recovery more and more abysmal. It’s a nightmare!

I’ve already explained that large-scale debt deleveraging will be one of the triggers that sends the global economy back into crisis. Now that Greece has defaulted on its $1.7 billion IMF payment, they’re looking more and more like the beginning of the end.

If Greece kicks the bucket, it could spill over to the other weak euro zone members — namely, Portugal, Italy, and Spain. Lance explained yesterday that investors who are fearing the worst from Greece dropped out of not only Greece debt but those other lower quality bonds as well.

With so many developed countries already sitting on the brink, and with the worst yet to come, it’s important to consider which countries will be hit the hardest… and which will fare the best going into the next recovery.

The truth is that, with the lower birth trends that come from increasing urbanization, wealth, and education, almost all developed countries have sideways (at best) to falling demographic trends for decades to come.

But there are a few exceptions…

And they are, in order: 1) Australia… 2) Israel… 3) Switzerland… 4) Norway… 5) Sweden… and 6) New Zealand.

In these countries, the millennials or “Echo Boomers” will ultimately bring them to new heights.

They’re the few countries that, unlike the U.S., saw a larger generation following their baby boom. These demographics are partially due to higher birth rates but mostly because of strong immigration policies.

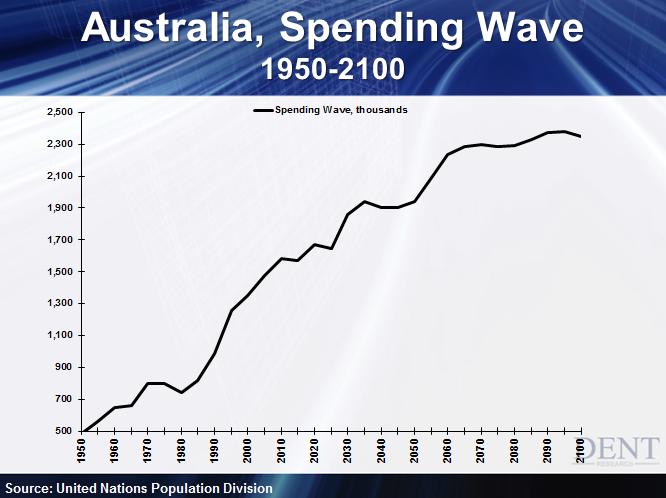

When you consider how the stronger demographics in a country like Australia translates into more spending, you understand why they’re at the top! Here’s a look at their spending wave from the middle of last century to the end of this one:

It’s been flat from 2010 to 2015, but after this, it’s the only developed country with slightly positive trends into 2018.

But in the first stage of the next global boom, from 2023 to 2036, Australia will have the strongest surge of any developed country. It’ll have a minor downtrend into 2045, but then another boom later on in the century, around 2065 to 2070.

Right now, Australia has the highest immigration per capita of any major, wealthy, developed country. It’s greater than even Canada or the U.S., which are immigration magnets. And it could continue to enjoy good immigration levels at times, even in the coming depression, as the wealthy flee countries such as China.

The bottom line is that Australia simply has the best demographic trends of any wealthy, developed country. While the bubbles in China, commodities, and their own real estate will hurt them especially in the next global financial crisis, there isn’t a country with lower debt, or one better positioned for the next boom.

The other five have similar patterns. They’ll see (or are already seeing) demographic downturns into the middle or end of next decade. After that, they’ll enjoy a surge going into 2040.

Unfortunately, in the grand scheme of things, those six are only smaller countries.

Australia only has a population of 23 million people. Sweden has even fewer at 9.5 million. And the others even less: Israel at 8.3 million, Switzerland at 8.1 million, Norway at 5 million, and New Zealand the lowest at 4.5 million.

Combined, these countries contain less than a sixth of the U.S. population.

The greatest demographic growth of all will come out of the emerging world, between 2023 and 2070. Those are the countries that will experience a boom due to greater urbanization and a growing middle-class consumer population (though they won’t become as affluent as their developed-world counterparts).

That’s when we could see the greatest commodity boom and bubble in history, as emerging countries dominate growth. And Australia, with its strong commodity exports, is perfectly set to ride the wave.

But in the first stage of the next global boom, from 2023 to 2036, Australia will have the strongest surge of any developed country. It’ll have a minor downtrend into 2045, but then another boom later on in the century, around 2065 to 2070.

Right now, Australia has the highest immigration per capita of any major, wealthy, developed country. It’s greater than even Canada or the U.S., which are immigration magnets. And it could continue to enjoy good immigration levels at times, even in the coming depression, as the wealthy flee countries such as China.

The bottom line is that Australia simply has the best demographic trends of any wealthy, developed country. While the bubbles in China, commodities, and their own real estate will hurt them especially in the next global financial crisis, there isn’t a country with lower debt, or one better positioned for the next boom.

The other five have similar patterns. They’ll see (or are already seeing) demographic downturns into the middle or end of next decade. After that, they’ll enjoy a surge going into 2040.

Unfortunately, in the grand scheme of things, those six are only smaller countries.

Australia only has a population of 23 million people. Sweden has even fewer at 9.5 million. And the others even less: Israel at 8.3 million, Switzerland at 8.1 million, Norway at 5 million, and New Zealand the lowest at 4.5 million.

Combined, these countries contain less than a sixth of the U.S. population.

The greatest demographic growth of all will come out of the emerging world, between 2023 and 2070. Those are the countries that will experience a boom due to greater urbanization and a growing middle-class consumer population (though they won’t become as affluent as their developed-world counterparts).

That’s when we could see the greatest commodity boom and bubble in history, as emerging countries dominate growth. And Australia, with its strong commodity exports, is perfectly set to ride the wave.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.